Introduction:

In today’s fast-operating retail environment, it is important to select the right modern payment terminal. It helps retailers to provide a smooth and secure retail checkout experience to their customers.

Today retailers require more than a basic card reader, they require an advanced retail POS system which provides speed, flexibility, and intelligent features.

The best payment terminals for retailers offer more than processing transactions, and also provide important features like contactless payment support, digital receipts, and mobile wallet compatibility to meet changing customer expectations.

Modern smart payment solutions for retailers now integrate smoothly with inventory systems, which enables real-time updates and smooth operations.

A POS terminal with inventory management not just makes stock control easier but also provides actionable insights through retail analytics integration.

With EMV and NFC support, secure payment processing, and PCI DSS compliance, these terminals provide strong protection for sensitive customer information.

Businesses who want to stay competitive should invest in integrated POS solutions which are cloud-based, customizable, and portable.

Whether it is a mobile payment terminal for curbside pickup or a cloud-connected payment terminal for multi-store reporting, it is important to have flexibility.

A customer friendly POS terminal with multi-payment POS support that includes cards, wallets, and QR codes which improves the checkout experience. In a world where speed, security, and efficiency matters the most, the right terminal helps retailers to grow with confidence.

So if you are the owner of a small boutique or a large multi-location store, the payment terminal you select can greatly impact your business’s success. Through this blog we will explore the top five features that every modern retailer should prioritize while selecting a payment terminal.

Multi-Payment Compatibility and Contactless Transactions:

The Need for Versatility:

It is essential for a modern Payment terminal to have features like Multi-payment compatibility and contactless transactions in order to meet different preferences of the customers.

In today’s times, shoppers expect the freedom to pay using credit and debit cards, mobile wallets, QR codes, and even emerging digital currencies.

A POS system with multi-payment options provides different payment options for the customers where they can make payments as per their conveniences. It eventually expands opportunities for businesses and captures more sales across different payment preferences.

Contactless transactions along with NFC technology ensures faster and safer checkouts reducing any need for physical contact.

By providing flexible payment options, it helps retailers to serve more customers and eventually build customer loyalty, which helps them to stay ahead of competitors in a digital-driven marketplace.

Benefits of Multi-Payment Support:

1. Enhanced Customer Experience:

Multi-payment terminal facility allows customers to make payment using different payment methods. They can either use credit/debit cards, mobile wallets, UPI, and QR codes for payments. It eventually ensures that the customers can make payments as they prefer which lead to smooth and fast checkouts.

2. Increased Sales Opportunities:

Multi-payment support ensures that the customers do not often abandon their cart which attracts a wide range of customers including even international and tech-savvy shoppers.

3. Business Flexibility and Future-Readiness:

It becomes easier for businesses to adapt to changing trends like digital currencies or region-specific wallets due to support for different payment options.

It further ensures scalability and competitiveness in a fast-changing retail industry.

Retailers like Starbucks and Target have adopted strong, multiple-compatible terminals, which allow customers to pay through app, wallet, or card – all within seconds.

Implementation Tips:

- Choose terminals that support EMV, NFC, and QR scanning.

- Ensure that the devices support new updates in order to ensure new integrations and feature enhancements effortlessly.

- Ensure that the local payment methods are supported for international retailers.

Strong Security and Compliance Features:

Strong security and compliance are essential features for modern payment terminals which eventually ensures customer data is protected and business integrity is maintained.

Retailers must ensure that their POS systems are PCI DSS compliant, which provides built-in encryption and tokenization which protects sensitive payment information.

With features like EMV chip support and NFC technology reduces the risk of fraud and chargebacks in each transaction.

Many advanced terminals also include end-to-end encryption and real-time threat detection providing advanced protection.

Due to the increasing risk of data breaches and changing compliance standards every day. It is important to invest in a payment terminal with strong security protocols which will be not just a smart decision rather a necessity for maintaining customer trust and meeting industry regulations.

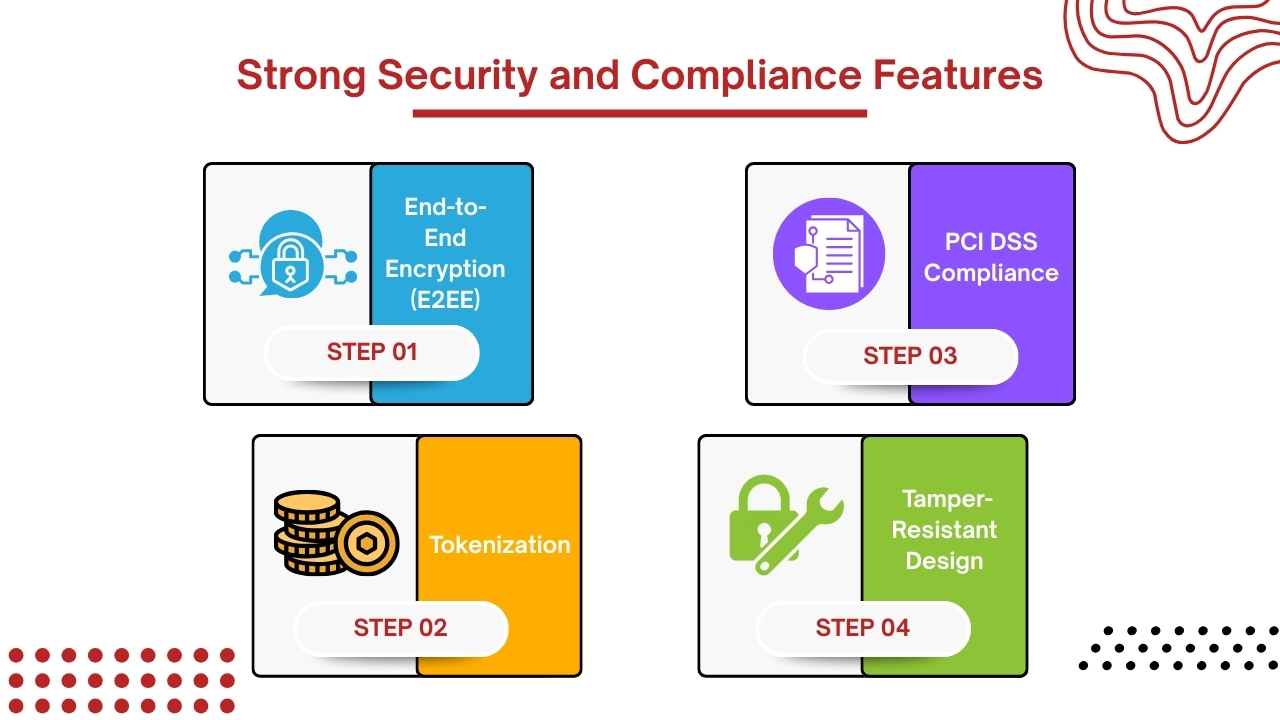

1. End-to-End Encryption(E2EE):

End-to-End Encryption encrypts card data at the terminal. Then the card data is transmitted securely to the payment processor. It eventually reduces the risk of data breaches.

2. Tokenization:

Tokenization will improve security. With tokenization, sensitive card details are replaced by random tokens. These tokens hold no value even if they are accessed during a breach.

3. PCI DSS Compliance:

Payment terminals that are PCI DSS compliant, guarantee that the payment terminal complies with strict security standards. It ensures that the card holder data is protected. It eventually reduces the chances of fraud or regulatory penalties.

4. Tamper-Resistant Design:

It features hardware that immediately shuts down or erases sensitive data after detection of any type of physical tampering. It prevents any type of unauthorized access and also improves payment terminal security.

Benefits for Retailers:

1. Reduced Fraud Risk:

Secure terminals protect against card skimming and data theft.

2. Customer Trust:

Shoppers are more likely to return if they feel their transactions and sensitive card data information are secure.

3. Regulatory Protection:

Compliance reduces legal and financial liability.

Integrated Inventory and Sales Tracking:

Integrated inventory and sales tracking is an important feature in modern point-of-sale(POS) systems. It helps businesses to improve efficiency and smooth operations.

With each sale, inventory levels are automatically updated. So there is no requirement for manually entering the data which eventually reduces the chances of any error or stockouts.

Due to this, retailers can easily monitor which products are selling well, slow-moving items, and also receive alerts when the stock is low.

Real-time updates regarding sales and inventory ensures they are making smarter purchasing decisions and improved customer satisfaction.

It gives valuable insights through reports on sales, profit margins and inventory turnover.

So if you are managing a single store or multiple locations, integrated tracking helps to maintain accurate stock levels, optimize re-order processes, and ensure that businesses run smoothly and profitably.

Modern terminals must be able to integrate effortlessly with the Point of sale system, inventory management system, and accounting systems.

1. Real-Time Inventory Syncing:

Instantly update stock levels after each transaction.

2. Sales Analytics:

Must track the top-selling products, time-based performance, and customer behavior.

3. Cloud-Based Reporting:

Users must have access to reports from anywhere, anytime.

4. Multi-Channel Support:

Combine sales data across online, mobile, and physical stores.

Benefits:

1. Smarter Decisions:

Having access to real-time data helps businesses to make smarter decisions. Due to which businesses can effectively plan restocking and promotions, manage inventory levels and improve customer engagement. It helps businesses to make maximum profits.

2. Streamlined Operations:

It reduces the need for manually entering data and minimizes errors. It helps businesses to improve efficiency, accuracy, and productivity. It helps teams to focus on important tasks and make strategic decisions.

3. Unified View:

A unified platform allows businesses to manage both inventory and finances smoothly from a single platform. You get real-time insights which helps to simplify workflows, ensuring accuracy and more control over business operations.

Shopify and Square offer POS terminals which functions both as inventory trackers and sales dashboards making them the best choice for both small and mid-sized retailers.

Customization and Branding Capabilities:

Customization and branding capabilities helps businesses to improve customer experience along with strengthening brand name.

Retailers often look for terminals that provide flexible design options for the user interface and receipts.

Being able to personalize the terminal screen with company colors, logos, and messages which creates a consistent and engaging brand experience during every transaction.

Other than the visual aspects, payment terminals should also integrate loyalty programs, allowing retailers to offer personalized discounts or rewards directly at the point of sale. It develops customer loyalty and improves engagement with the brand.

Being able to display dynamic promotions or up-sell options directly on the terminal screen.

This not just helps businesses to increase sales but also promote new products or seasonal offers.

While cloud-based systems for easy remote updates and management allow retailers to maintain consistency across locations.

Such features ensure that branding remains smooth, adaptable, and effective, and develop a strong connection between the business and its customers.

1. Customer Receipts:

Must include your logo, promotional messages, or website link.

2. Loyalty Integration:

Let customers earn or redeem rewards directly on the terminal.

3. Multi-Language Support:

Must cater to different types of customer bases.

4. UI Personalization:

Customize the touchscreen interface to reflect your brand colors or experience.

Business Impact:

1. Improved Customer Retention:

Customers feel valued with personalized experiences.

2. Upsell Opportunities:

Suggest add-ons or memberships at checkout.

3. Brand Recall:

Consistent branding will help brands to strengthen recognition, build trust, and ensure your business identity is easily remembered by your customers in competitive markets.

For instance a boutique clothing store might promote flash sales or collect customer emails for loyalty programs during checkout.

Mobility and Cloud Connectivity:

Mobility and Cloud Connectivity are important features that modern retailers should look for while selecting a payment terminal.

It ensures that your POS system is not for a single checkout counter, rather enabling sales anywhere in the store, at pop-up events, or even for home deliveries.

Such flexibility improves customer experience because they don’t have to stand in long queues and meet shoppers where they are.

Cloud connectivity improves business operations because it allows real-time synchronization of sales, inventory, and customer data across multiple devices and locations.

So, if you operate a single store or a chain, cloud-enabled payment terminals allow immediate access to transaction records, performance reports, and customer insights from any internet-connected device. It not just makes the operations smooth but also supports data-driven decision-making.

On top of that, cloud-connected mobility ensures that software updates, security patches, and feature enhancements can be deployed remotely without downtime, keeping your terminal secure and compliant.

It also facilitates integration with loyalty programs, CRM systems, and e-commerce platforms, thus creating a unified retail ecosystem.

By combining mobility with cloud capabilities, retailers gain operational agility, scalability, and a competitive advantage. In today’s fast-evolving retail environment, a modern payment terminal with such features is not just an upgrade; rather it’s a necessity for both growth and customer satisfaction.

Modern retail does not operate from a single checkout counter; rather there could operate from a pop-up shop, outdoor market, or curbside pickup, so mobility matters.

Features to prioritize:

1. Portable devices:

Lightweight, battery-powered terminals with wireless connectivity.

2. Cloud Sync:

Automatically updates sales and inventory data to the cloud.

3. Offline Mode:

Process payments even when the internet is down.

4. Bluetooth and Wi-Fi Capabilities:

For smooth integration with barcode scanners, printers or tablets.

Benefits of a Mobile Terminal:

1. Serve Anywhere:

It is the best option for events, trade shows, delivery, or restaurants.

2. Reduced Wait Times:

Line busting strategies during peak hours helps to speed up transactions, reduce customer frustration, and improve overall shopping experience which lead to increased customer satisfaction and loyalty.

3. Data Accessibility:

Review performance metrics and insights from anywhere.

Retailers are increasingly using tablet-based payment systems or handheld devices, mainly in fast-moving environments like food trucks.

Additional Features worth Considering in a Modern Payment Terminal:

1. Customer Feedback Collection:

Prompt customers to leave quick feedback or ratings on the terminal.

2. Split Payments and Tip Options:

Allows customers to split bills or add tips easily which is a must-have feature for cafes and restaurants.

3. Digital Signature and Receipt Options:

Captures signatures and email/text receipts in order to save paper and improve tracking.

4. API Integrations:

Choose terminals that offer open APIs to connect with CRM, eCommerce, or loyalty platforms.

How to Choose the Right Terminal for Your Business

While selecting a payment terminal, it is important to select a terminal that is the right fit for your business operations. It is only by following a structured approach that helps you to make a cost-effective and the right decision.

Step 1: Understand your Needs:

Whether you are operating from a single store, or manage multiple branches, it is important to define what your business exactly requires. If you are running a mobile business like a food truck or participate in events, portability and wireless connectivity will be important.

And if you are running retail or restaurants, then a countertop model with strong integration is the best option. So identify your priorities like payment method compatibility, inventory integration, or customer loyalty features before selecting a payment terminal.

Step 2: Research Providers:

So once you know about your needs, it is important to compare providers like Square, Clover, Stripe, Toast and Lightspeed.

You must search about different expenses before selecting a payment terminal, like the total cost of ownership, including translation fees, monthly charges, and hardware expenses.

Also check about other factors like ease of use, user interface, and whether the system integrates effortlessly with your POS, accounting software, or eCommerce platform.

Step 3: Check for Local Support:

Even the best technology can fail if you don’t have strong support. Ensure your provider offers quick, reliable customer service, and technical assistance in your region. With local support you get faster resolution for your issues, reduce downtime, and lost sales.

Step 4: Pilot Before Full Rollout:

It is important to test the payment terminal in the real-world before making the actual purchase. It helps to simulate daily business conditions like busy transaction periods to slower periods.

By involving frontline staff helps to get practical insights on speed, ease of use, and any potential challenges.

It is only by following these steps, that you reduce the risk of costly mistakes and ensure that the terminal you choose improves both operational efficiency and your customers are satisfied.

A well-planned decision can lead to smoother transactions, happier customers, and a more profitable business tomorrow.

Conclusion:

In today’s fast-operating retail environment, a modern payment terminal not just helps processing transactions, rather it’s an important tool for improving customer experience and business efficiency.

Some of the important features that you must look for while selecting a payment terminal include multi-payment method support, strong security and compliance, POS integration with cloud connectivity, portability, and flexible connectivity, and smart analytics or value-added features.

It is only by offering different payment options, that you attract more customers as the customers get to pay as per their preferences which encourage repeat business.

Payment terminals with strong security protect customer data information by keeping sensitive customer data secure.

Seamless POS integration and cloud-based system enable real-time insights, inventory management, and remote updates, thus keeping your operations agile.

Portability and flexible connectivity makes sure that you can serve customers anywhere. Finally, analytics and additional tools help you to make informed decisions to drive growth.

Investing in a payment terminal with such capabilities ensures that you are not just keeping pace with technology but also staying ahead of customer expectations.

The right device can make operations smooth, reduce checkout times, and build trust which will contribute to long-term profitability. A well-chosen payment terminal is not just an expense but a strategic asset for any forward-thinking retailer.