Introduction:

Retail payment methods are transforming how shoppers browse, buy, and return both online and at the point of sale(POS).

In 2025, smart retailers stop chasing the lowest rate and build a balanced payment system that raises conversion and approval rates, increases customer lifetime value, and lowers fraud, chargebacks, and the actual cost of acceptance across in store, online, and mobile channels for every purchase.

Begin with EMV chips and contactless payments, and offer digital wallets like Apple Pay and Google Pay to deliver fast, secure card-present checkout. Enable SoftPOS(Tap to Pay or Tap on Phone) to turn NFC smartphones into mobile terminals for avoiding long queues, and in-aisle assistance.

Go beyond cards with account-to-account(A2A) instant payments where they are accelerating worldwide like UPI in India, FedNow and RTP in the United States, and SEPA Instant in Europe.

Incorporate QR code payments, BNPL installments, gift cards, store credit, and loyalty redemptions so customers can pay on their terms while you safeguard margins.

In e-commerce and apps, smooth card-not-present checkout with Click to Pay(EMV SRC), EMV 3-D Secure for strong authentication, and network tokenization to keep credentials updated through reissues and improve approval rates.

Security, compliance, and resilience are non-negotiable. PCI DSS v4.0 expects tighter page-integrity controls for web-checkout, while point-to-point encryption(P2PE) and tokenization reduce in-store data exposure and reduce PCI scope.

Design for unified commerce with a single customer profile, a unified token vault, and a cross-channel view of orders, refunds, and balances so then choose platforms which provide high uptime, smart routing, and strong reconciliation and settlement reporting, and evidence-driven dispute management.

The throughline is choice, speed, and trust. Offer the retail payment methods your market prefers, instrument them well, and measure relentlessly.

When optimized, payments become a strategic advantage, speeding checkouts, improving approval rates, improving margins, and deepening loyalty across POS, web, and mobile.

Also Read: How to Choose the Right POS System

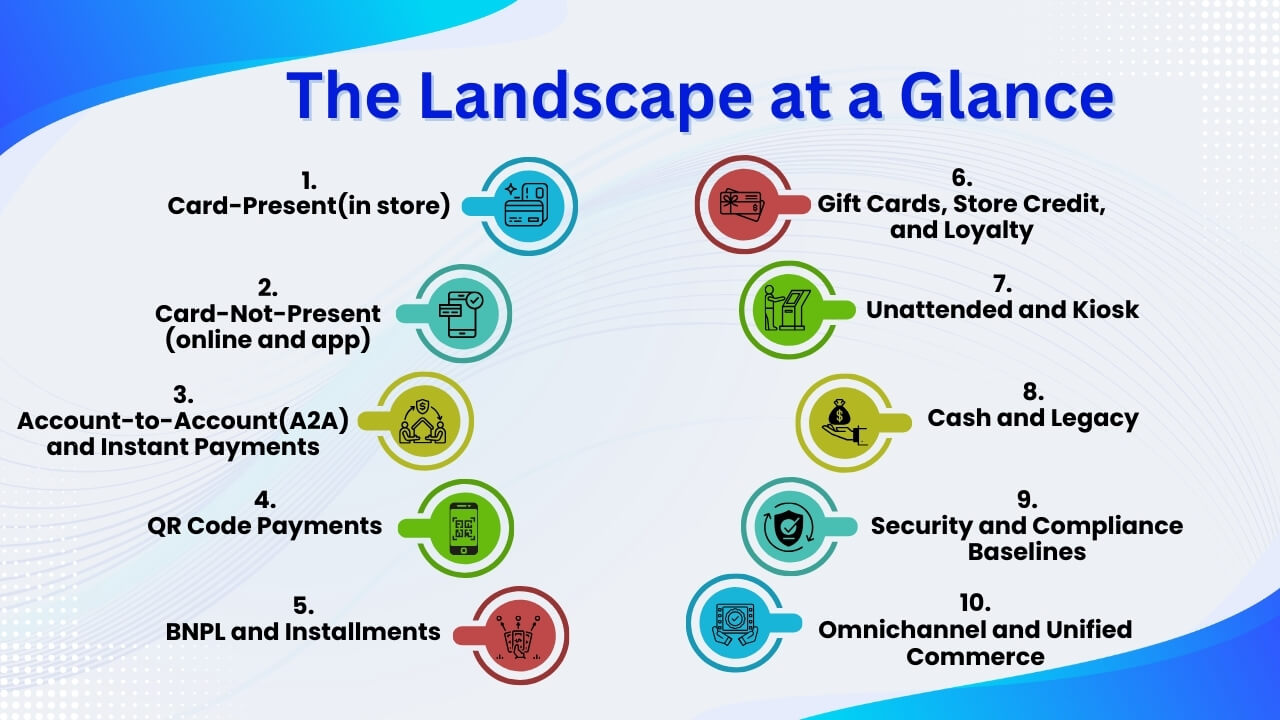

The Landscape at a Glance

Retail payment methods in 2025 expands far more than “cash or card”. The modern payments spans over EMV chip, contactless and wallet-based cards, instant account-to-account rails, QR payments, BNPL, gift cards and loyalty, along with specialized options for subscriptions and unified experiences.

The goal is to maximize conversion and approval rates while reducing fraud, chargebacks, and the true total cost of acceptance.

1. Card-Present(in store):

EMV chips and contactless payments remain the backbone of point-of-sale (POS). At many checkout counters, tap-to-pay has become the go-to-move, speeding transactions and cutting down on readers.

Enable digital wallets like Apple Pay and Google Pay to harness tokenized credentials and device-level security, delivering a smoother tap experience that can lift approval rates.

To mobilize checkout, deploy SoftPOS(Tap to Pay/Tap on Phone) so NFC smartphones act as PCI-compliant terminals ideal for busting queues, handling curbside orders, easing peak-time lines and enabling assisted selling on the shop floor

2. Card-Not-Present(online and app):

Successful e-commerce demands low friction and maximum trust. Offer Click to Pay(EMV SRC) as the card button besides wallets, reducing manual entry and abandoned carts.

Use EMV 3-D Secure for stronger customer authentication with risk-based, mostly invisible flow that preserves conversion. Adopt network tokenization so stored cards survive reissues and lifecycle events, improving authorization stability for subscriptions, saved cards, and one-click checkout.

Also Read: Top 5 Features Every Retailer Should Look into Modern Payment Terminal

3. Account-to-Account(A2A) and Instant Payments:

Across major markets, real-time bank-to-bank rails – UPI, RTP or FedNow and SEPA Instant have become standard for everyday payments. They offer lower acceptance cost, immediate settlement, and fewer chargeback liabilities as compared to card networks.

Common retail use scenarios include Pay-by-Bank checkout, instant refunds, gig-worker payouts, and bill-to-bank setups for recurring charges. Because consumer protections and refund flows differ from cards, publish clear policies up front and provide transparent and real-time status updates.

4. QR Code Payments:

QR can be static or merchant ID or dynamic(amount+invoice embedded). It is valuable for counterless venues, pop-ups, food halls, events, and markets where scanning is culturally common.

Dynamic QR eases reconciliation and reduces keying errors. Use table tents, floor decals, and cashier prompts to make it clear where and how shoppers should scan.

5. BNPL and Installments:

Buy Now, Pay Later improves conversion and average order value for mid-to-high-ticket purchases. Offer it transparently(total cost, schedule, late fees) and align returns, refunds, and partial exchanges with provider rules. Measure the method’s incremental lift in conversion and Average order value against MDR and dispute rates to verify it genuinely protects margin.

6. Gift Cards, Store Credit, and Loyalty:

Gift cards, store credit, and loyalty drive retention while lowering external fees. Offer instant digital gift cards, enable partial redemptions, and route refunds to store credit to keep value inside your brand.

Synchronize gift-card and loyalty balances across POS and e-commerce, apply enhanced fraud checks, high-value activations, and monitor breakage alongside earn-and-burn metrics.

7. Unattended and Kiosk:

Unattended and kiosk payments cover vending, ticketing, parking, and micro-markets. Prioritize EMV L2 contactless, clear on-screen prompts, and optional printed or digital receipts.

Support offline or stand-in rules, failback to QR or NFC wallets, and remote monitoring. Harden devices with P2PE, tamper detection, and shields, and keep token portable so kiosk orders complete at staffed counters effortlessly.

8. Cash and Legacy:

Cash still matters for certain regions, ages, and contexts in rural areas, low-banked shoppers, tipping, and small tickets. Maintain at least one dependable cash lane with trained staff, counterfeit checks, secure tills, and end-of-day reconciliation.

Keep floats sized for peak hours and coin shortages. Offer cash-to-digital options(reloadable gift cards, bill pay) to bridge journeys. Checks and money orders are niche – offer them only when demand justifies it, with clear holds, verification, and fees to cover processing risk.

9. Security and Compliance Baselines:

Use point-to-point encryption(P2PE) for card capture, tokenize everything possible, and minimize PCI scope. For web, meet PCI DSS v4.0 by maintaining an approved script inventory, authorizing third-party code, and enabling change or tamper detection with alerting.

Align fraud controls with business goals by combining device intelligence and velocity limits, with risk scores driving EMV 3-D secure orchestration. Close the loop with detailed logging, well-defined post-auth dispute workflows, disciplined evidence retention, and recurring testing, audits, and operational runbooks.

10. Omnichannel and Unified Commerce:

Use a single token vault and customer profile so a card saved online can be used in store, loyalty points can redeem anywhere, and orders or returns are visible across channels.

Prioritize uptime, smart routing, clean reconciliation, and evidence-rich dispute tooling to create a flexible payments portfolio that meets customer preferences, protects margin, and scales with demand.

Card-Present Payments

Card-present payments center on EMV chip and contactless, with digital wallets like Apple Pay and Google Pay delivering fast, tokenized taps. Add SoftPOS to turn NFC phones into terminals for queue-busting.

Use P2PE devices, prompts, and placement to improve speed, approvals, and security at checkout.

1. EMV chip (dip) and contactless (tap):

EMV chip(dip)authenticates cards with dynamic cryptograms, cutting counterfeit fraud but adding a brief insert step. Contactless(tap) uses NFC for fast, secure transactions with the same EMV protections.

Promote tap-first flow, clear reader affordances, and high-value PIN rules to speed lines, lift approvals, and reduce mis-swipes or fallback through signage, placement, and training.

EMV chip is the worldwide standard for securing in-store card payments. Contactless speed checkout by letting customers tap a curd or device on an NFC-enabled reader. Across many markets, tapping has become the standard checkout gesture backed by card networks and NFC wallets.

Advantages: Fast checkout, high approval rates, familiar UX.

Disadvantages: Hardware costs, certification cycles, occasional limits for high-value transactions by market or issuer.

Also Read: The Future of Retail Payments

2. NFC wallets (Apple Pay, Google Pay, wearables):

NFC wallets like Apple Pay, Google Pay, and wearables tokenize card credentials, add device biometrics, and generate dynamic cryptograms at tap.

They speed checkout, reduce data exposure, and often lift approvals through richer issuer risk signals. Enable wallet acceptance on terminals and apps, surface wallets buttons prominently, and connect loyalty so customers are recognized automatically at checkout.

For high-value contactless transactions, implement PIN where required and confirm regional transaction limits and cardholder messaging before rollout. Digital wallets tokenize card credentials and often lift approval rates by supplying stronger cryptograms and device-level risk signals to issuers.

On iPhone, Tap to Pay on iPhone lets merchants accept contactless payments using only an iPhone and a supported app with no additional hardware required. This is rolling out across multiple countries and PSPs.

Advantages: speed, privacy(device pan masking), and conversion(especially when combined with loyalty).

3. SoftPOS (Tap-to-Phone / Tap-on-Phone):

SoftPOS turns NFC-enabled smartphones into payment terminals, allowing merchants to accept contactless cards and wallets with no extra hardware. Being ideal for pop-ups, couriers, and field services, it speeds checkout and lowers costs. Intuitive apps guide staff through checkout, prompt for gratuities, and deliver receipts instantly via SMS, email, or QR code.

For higher-value transactions, customers enter their PIN on their phone’s secure screen(“PIN on Glass”) to authenticate the cardholder.

Choose platforms certified to PCI CPoC/MPoC that use tokenization with layered risk controls, deliver live reporting, enable easy refunds and remote fleet management, and include device attestation, and white-label branding.

For high-value tap payments, enable PIN where mandated and verify local contactless limits and cardholder messaging before going-live.

Advantages: near-zero hardware, fast onboarding, which is great for long queues and mobile associates.

Disadvantages: accessory readers may still be needed for PIN on high-value or fallback scenarios based on your region, scheme rules, and PSP support.

Also Read: Smart POS System

Card-Not-Present (online & remote)

Card-not-present covers ecommerce, pay-by-link, and phone orders. Secure checkout depends on tokenization, 3DS/SCA, AVS/CVV, and risk scoring in order to reduce fraud and chargebacks.

Increase approvals by routing each transaction to the best-performing acquirer in real life and intelligently retrying soft declines. Provide guest checkout and card vaulting, enable instant refunds, and issue clear receipts while maintaining full PCI DSS compliance.

1. Classic card checkout vs. Click to Pay (EMV SRC):

Classic card checkout asks shoppers to type PAN, expiry, CVV, and address into form fields. Though it’s universal and familiar, it is slow, error-prone, and increases cart abandonment especially on mobile.

Click to Pay(EMV SRC) replaces manual entry with a network logo button that exposes the shopper’s stored, tokenized card in a secure, consistent experience that works across participating merchants.

After a one-time authentication, shoppers pick a card from a standardized interface, while EMV cryptograms and network tokens reduce fraud and keep credentials current without the merchant storing raw card data.

Result: fewer fields, faster completion, stronger security, and higher approval rates. Support both: keep classic as a safety net and make Click to Pay your primary, speed first flow.

Traditional card forms are familiar but error prone; and every mistyped digit hurts conversion.

Where to use: use it for guest checkout, cross-border traffic, and wallets-first designs when a universal card button clarifies choice; place Click to Pay alongside Apple Pay or Google Pay as the one tap card option.

2. 3-D Secure 2.x (EMV 3DS) for Strong Customer Authentication:

EMV 3DS 2.x enforces Strong Customer Authentication on remote card payments, usually doing so in a low-friction, risk-based flow.

By sending detailed transaction, device, and behavioral signals to the issuer, 3DS enables risk-based decisions low-risk payments glide through while higher-risk ones trigger step-up via biometrics, app push, or one-time passcodes.

With the right configuration, 3DS satisfies PSD2 SCA in the EEA/UK, reduces fraud, and moves chargeback liability onto the issuing bank. Implement low-value, TRA, and trusted-beneficiary exemptions, auto-retry soft declines with SCA step-up, and keep resilient fallbacks in place.

Use certified 3DS servers and SDKs for web and in-app flows, monitor challenge rates and risk telemetry, and coordinate with issuers to raise approvals without sacrificing security.

EMV 3DS lowers CNP fraud with risk-based checks and step-ups like OTPs or biometrics, and when tuned it improves approvals and liability outcomes.

Best practices:

- For low-risk scores, route transactions through frictionless 3DS to avoid challenges and keep smooth checkout.

- Provide issuers with detailed device fingerprints, account age, and past-transaction signals to drive frictionless decisions and reduce challenges.

- Use network tokens alongside 3DS so credentials auto-update through card reissues reducing expiry declines and keeping approvals stable over the card lifecycle.

3. Network Tokenization:

Network tokenization replaces the primary account number(PAN) with a unique, card-network issued token that’s domain controlled to a merchant, device, or channel.Card networks like Visa and Mastercard provision and vault tokens, refreshing them automatically after card reissues to reduce expiry-related declines.

Used alongside cryptogams and device intelligence, tokens raise authorization approvals and reduce fraud by blocking replay and misuse across merchants. They support lifecycle management, maintain up-to-date card-on-file details, and make subscription billing smooth.

Because issuers recognize network tokens(unlike gateway vault tokens), they improve risk scoring and liability outcomes. Implement them via network tokenization APIs or acquirer integrations.

Account-to-Account (A2A) and Instant Payments

Account to account(A2A) and instant payments move money between bank accounts without cards, reducing fees and delays. By using rails like RTP, FedNow, UPI, Faster Payments, and Pix, they deliver real-time confirmation, payment finality, and rich remittance information.

Merchants benefit from lower costs, fewer chargebacks, and faster liquidity; consumers gain quicker refunds and bill pay. Increase adoption by offering payment request links, QR-code checkouts, and intelligent routing.

1. UPI (India):

UPI is India’s instant, account-to-account payment system which is run by NPCI. It links one or more bank accounts to a mobile app and a simple UPI ID, which enables 24/7 transfers with a UPI PIN.

Consumers pay by scanning interoperable QR codes, entering a UPI ID, or responding to collect requests. Merchants benefit because of low costs, real-time confirmation, and reconciliation.

Features include mandates for subscriptions(AutoPay), P2P, and P2M flows, refunds, and support for credit on UPI via RuPay cards. UPI Lite offers small-value offline-friendly payments. Popular apps are BHIM, PhonePe, Google Pay, and Paytm, with settlement rails and wide bank interoperability.

2. FedNow & RTP (United States):

FedNow and RTP are the United States’ instant payment rails that move funds account-to-account in seconds, 24/7. RTP is operated by The Clearing House, which is a private network used by many large banks; FedNow is the Federal Reserve’s service broadening access across community banks and credit unions.

Both run as credit-push systems, deliver immediate funds availability, and use ISO 20022 message formats. Core features include Request for Payment, rich remittance data, real-time confirmations, and irrevocable transfers that reduce chargeback risk.

Merchants see faster cash flow and cleaner reconciliation, billers post instantly, and fintechs embed instant pay-in and pay-out experiences. Adoption depends on participating banks being ready and the end-user experience being smooth.

3. QR Code Payments:

QR code payments allow customers to scan a code with a phone to initiate checkout, linking to a wallet, banking app, or web flow. Merchants can use static codes for fixed IDs or dynamic code that encode amount, invoice, and tip.

EMVCo specs standardize QR payloads, enabling interoperability across card networks and A2A rails like UPI, Pix, and Faster Payments. Benefits include low hardware cost, curbside and table service support, and offline fallbacks. Security comes from tokenized payloads and app authentication. App branding, receipts, and smart routing to raise conversion.

QR codes can be static, which is a fixed merchant ID or dynamic, encoding the invoice(for instance amount) for each transaction. UPI QR in India sets the benchmark for mass-market QR acceptance, while EMVCo’s EMV QR standard enables interoperable, cross-scheme acceptance globally. At the point of sale, QR pairs with tap to support line-busting and counterless checkouts.

Tips:

- Select dynamic QR so each transaction carries amount and metadata, enabling itemized receipts and smoother reconciliation.

- Include clear cashier prompts and signage without guidance, QR without guidance suffers conversion.

- Monitor false positives from camera focus and validate performance on low, mid, and high-tier devices.

BNPL and Installments

Buy Now, Pay Later(BNPL) and installments allow consumers to split purchases into scheduled payments often with zero or low interest. Providers assess risk using soft credit checks, device signals, and repayment history, then underwrite per-transaction limits.

For merchants, BNPL improves conversion and Average order value, surfaces financing in checkout, and shifts fraud and credit risk to the BNPL provider. But costs include higher MDR, and potential chargebacks on first payments.

Offer clear terms, caps, and collections policies, and support partial refunds. Place BNPL smartly on product pages, cart, and checkout; use API pre-approvals; and continuously monitor approval rates, late fees, disputes, and regulatory changes.

1. Gift Cards, Store Credit, Loyalty & Closed Loop:

Gift cards, store credit, and loyalty points form a closed-loop value system that keeps spend inside your brand and lowers payment costs. Issue cards digitally or in-store, link them to customer profiles, and support earn, redeem and balance checks across all channels. Use personalized offers, expiry reminders, and bonus multipliers to prompt repeat visits and larger baskets.

Offer instant refunds to store credit to save sales. Prevent fraud with velocity and balance-check limits. Provide RESTful endpoints for gifting, exchanges, and corporate bulk purchases, along with real-time reporting and reconciliation dashboards. Gift cards and points act as closed-loop rails, minimizing processor fees and retaining value on-platform. Modern POS and e-commerce platforms let you:

- issue e-gift cards on the spot, redeemable in store, on the web, or in-app.

- let customers pay with points at checkout, with live balance verification.

- Offer store credit as the primary refund method to reduce costs and preserve on-platform spend. Offer store credit as the primary refund methods to reduce costs and preserve on-platform speed.

Security & Compliance Essentials

Minimize PCI score with hosted fields, tokenization, and vaulted cards. Use EMV chip or contactless plus PCI-validated P2PE or E2EE, with keys in HSMs. Enforce TLS 1.2+, HSTS, CSP/SRI, integrity checks and add 3DS2 with AVS or CVV, device risk, velocity, and blocklists.

Apply device hardening, firmware whitelisting, and maintain end-to-end chain-of-custody logs. Implement network segmentation, mandatory MFA, automated secret rotation, and SIEM ingestion.

Comply with GDPR or CCPA by collecting only what’s necessary, strict retention windows, and purging on schedule. Maintain documented runbooks, continuous training, strict supplier reviews, clear reconciliation dashboards, and preserve immutable, audit-ready reports.

1. PCI DSS v4.0 Deadlines and Scope:

PCI DSS v4.x is now in force which was superseded by v4.0.1 on December 31, 2024. All future-dated controls became mandatory March 31, 2025 and it applies to any entity that stores, processes, or transmits card data across the payment chain.

Action items:

- Require pre-prod review and sign-off before any script joins the checkout allow-list; log every update.

- Continuously verify code, configs, and assets for tamper, firing real-time alerts and auto-rollback when unauthorized changes appear.

- A/B test challenge flows regionally and tune based on approval, card abandonment, and fraud metrics.

2. EMV 3-D Secure (3DS):

EMV 3-D Secure(3DS) adds strong customer authentication to card-not present payments using risk-based evaluation. Offers liability shift, PSD2 routing, and deep issuer data to raise approvals, control fraud, and improve chargebacks on web and app experiences.

3. Point-to-Point Encryption (P2PE):

P2PE encrypts card data from capture to decryption in the solution provider’s environment, sharply reducing merchant PCI scope. Check PCI SSC listings for validated P2PE solutions and the most current program guidance.

4. Tokenization:

Tokenization replaces sensitive PANs with non-exploitable tokens, stored in a secure vault or provider. It reduces PCI scope, reduces breach, enables frictionless recurring payments, supports network tokens, and simplifies lifecycle management and credential updates.

Cost, approval, and risk: Getting the Trade-Offs Right

Payments optimization is a balancing act across cost, approval, and risk. Lower cost with smart routing, interchange optimization, surcharging or discounts where compliant, and shifting suitable flows to lower-cost rails like A2A or ACH.

Improve approvals using network tokens, richer data, account updater, smart retry logic, and issuer-tuned descriptors. Manage risk with layered fraud controls, targeted 3DS, velocity and behavioral analytics, and refund or return policies designed to deter abuse.

Group by product, ticket size, market, and channel; set rules and routing which is tuned to each BIN and issuer. Measure everything, run controlled A/Bs on challenges, and govern changes by marginal return on investments and not averages.

1. Direct Fees:

Direct fees include interchange plus scheme assessments on cards, PSP fees for wallets and BNPL, and A2A platform charges per payment, shifting by region, tiering, transaction profile, and risk.

2. Indirect Fees:

Indirect fees span around fraud losses, chargebacks, authorization declines, failed retries, manual reviews, support time, reconciliation effort, payout delays, dispute handling and compliance overhead like evolving PCI DSS 2025 changes, these costs quietly reduce margins through added labor, tooling spend, and customer abandonment.

Hardware & Software Acceptance Options

1. Traditional POS:

Countertop or handheld terminals with chip or tap, receipt printing, and PIN entry deliver high-throughput checkout. Demands managed devices like updates, key loads, remote oversight and supports PCI-compliant P2PE or E2EE.

2. mPOS + reader:

Low-cost readers connect to tablets or phones via Bluetooth or USB which is ideal for pop-ups; require PIN on high-value taps and provide chip fallback.

3. SoftPOS:

SoftPOS turns NFC smartphones into terminals which is ideal for roaming staff and delivery with no hardware to ship and centralized management; for examples include Tap to Pay on iPhone and Visa or Mastercard Tap on Phone programs.

Also Read: What is Payment Processing Software

4. Kiosks and Unattended:

For transit, vending, ticketing, and parking, choose contactless-first devices with EMV Level 2-certified kernels, rugged enclosures, remote monitoring, and both printed and digital receipt options.

5. E-commerce Gateway or PSP:

Focus on availability, routing intelligence, tokenization, and risk depth across many APMs which is backed by network tokens, account updater, adaptive retries, 3DS, and a unified reporting layer.

2025 trends to watch

1. Open Banking/A2A Goes Mainstream:

UPI,SEPA Instant, and FedNow power bill pay, payouts, and refunds with lower fees; gateways add risk, onboarding, and refund workflows.

2. Tokenization-First Checkout:

Network tokens, Click to Pay, and passkeys drive approval lift and fraud detection; using account updater and maintaining credential-on-file hygiene improves subscription renewals and recurring performance.

3. SoftPOS and Contactless Everywhere:

Tap to Pay on iPhone or Android scales; kiosks and unattended retail go contactless-first; QR remains dominant in APAC for small, and frequent purchases.

4. Compliance, Risk, and Ops:

PCI DSS v4.0 enforcement, smarter 3DS, first-party fraud tooling, and unified reporting; experiment-driven routing and retries maximize approvals while protecting margin.

Fraud & Risk Controls

1. Signals and Screening:

Layer data-driven defenses: network tokens, device fingerprints, behavioral biometrics, AVS/CVV, email/phone intelligence, and IP/proxy reputation. Score risk in real time with velocity and anomaly models; block bots, throttle spikes, or step up suspicious flows.

2. Smart Step-up and Policy:

Challenge intelligently use selective EMV 3DS with exemptions and soft-decline recovery, route by BIN or issuer, secure accounts with MFA and session binding and deter first-party abuse via clear returns, negative or allow lists, velocity caps.

3. Operate and Optimize:

Enable chargeback alerts and evidence pipelines, descriptor testing, post-authorization screening, and issuer-savvy retries. Track approvals, fraud, and false positives per channel or region; A/B test controls and tune models depending on return on investment.

Conclusion:

Retail payment methods are no longer just a static checklist; it is a portfolio to consider for conversion, cost, and risk across web, app, and store. The goal is unified commerce: one brain coordinating tokens, orders, fraud signals, and tenders so customers can start in one channel and finish in another without friction.

Build a flexible payment stack – cards with network tokens and Click to Pay, wallets, BNPL for financing, and account-to-account rails for low-cost, instant movement then meet customers where they are with POS, mPOS, SoftPOS, kiosks, and ecommerce.

High-impact payment stacks increase approvals and preserve profitability. Must use data enrichment, updater services, issuer-aware routing, and intelligent retries to lift auth rates; deploy QR/A2A or stored credentials for repeat, low-value flow.

Ensure security first by implementing EMV and PCI-validated P2PE or E2EE in store; hosted fields, CSP or SRI, and page-integrity monitoring online; region-tuned 3DS to balance friction and liability shift. Enforce governance via documented policies, role-based training, supplier vetting, finance-grade reconciliation views, and append-only audit logs.

Make payments a product : baseline metrics, A/B test step-ups and wallet prominence, segment by BIN or issuer and region and iterate to marginal Return on investment. With disciplined execution and continuous measurement, payments stop being just a cost center and become a durable growth lever for your brand.