If you accept card payments online or plan to, you have probably got into the terms such as payment gateway and payment processor. They often show up together in sales pitches and pricing pages, which makes it easy to assume that they are the same thing. But in reality, the payment gateway versus payment processor question is one of the most important parts of building a smart payments strategy.

Both are crucial to making online payments work, yet they play very different roles:

- The payment gateway is the secure “front door” that captures your customer’s card or wallet details and sends them safely for approval.

- The payment processor is the “engine” that talks to the banks and card networks, moves the money, and settles funds into your merchant account.

Understanding the difference between a payment gateway and a payment processor affects far more than just technical architecture. It impacts:

- Your transaction fees and effective rate.

- Your checkout conversion rate and customer experience.

- How well you handle subscriptions, refunds, and chargebacks.

- Whether you can support high-risk industries, multiple currencies, or alternative payment methods.

- How easily you can switch providers or scale into new markets.

Through this guide, we will break down what a payment gateway is, what a payment processor is, how they work together in a typical transaction, and the pros and cons of using an all-in-one provider versus separate gateway and processor. By the end, you will know exactly how to evaluate “payment gateway versus payment processor” for your business and how to choose a setup that improves conversions, controls costs, and keeps your cash flow steady.

Also Read: Retail Payment Methods Transforming the Market

What is a Payment Processor?

A payment processor is the behind-the-scenes engine that makes electronic payments actually happen. When a customer pays with a credit card, debit card, or digital wallet, the payment processor takes the transaction details and passes them through the card networks to the correct banks.

It acts as a middle layer between the customer’s bank(issuer) and the business’s bank(acquirer), thereby ensuring funds are securely transferred from the customer’s account to the merchant’s account.

Along the way, the processor checks whether the card is valid, if there are enough funds or credit available, and whether the transaction looks suspicious or any chances of fraud.

For this service, processors charge fees which are mostly a combination of a percentage of each transaction and a fixed amount covering risk management, infrastructure, and compliance with payments regulations and card network rules.

Also Read: What is Payment Processor Software

What is a Payment Gateway?

A payment gateway is the secure “bridge” that collects payment information from the customer and sends it to the payment processor. In an online environment, it’s the technology behind the checkout page or payment form where customers enter their card details.

It’s basically the digital version of a point-of-sale(POS) terminal that you will find at a physical checkout counter. The gateway encrypts sensitive data, applies security checks, and ensures that information is transmitted using industry-standard protections like PCI DSS compliance and strong encryption protocols.

It does not actually transfer the funds rather that is handled by the processor but it ensures that the payment data is secure, accurate, and packaged in the accurate format so that the transaction can go through smoothly.

By using a payment gateway, businesses avoid directly handling or storing raw card numbers reducing their security risk and compliance burden while offering customers a fast, secure checkout experience.

Also Read: How to Choose the Right POS System for Your Business

Imagine the roles of payment gateway and payment processor clearly

- Think of the payment gateway as the secure front door of your online checkout.

- Think of the payment processor as the plumbing behind the walls which actually moves the money.

1. Payment Gateway = Secure Front Door

- It captures card details or digital wallet information.

- It encrypts and safely sends that data onward.

- Focus is on security, authorization requests, and protecting sensitive information.

2. Payment Processor = Money-Moving Plumbing

- It quietly communicates with the banks and card networks behind the scenes.

- It approves or declines the transaction based on funds and risk.

- It handles the actual flow of money from the customer to the merchant.

3. Separate or Bundled, But still two layers

- Sometimes both payment gateway and payment processor are two different providers.

- Sometimes both payment gateway and payment processor are bundled into one platform.

- Conceptually both payment processor and payment gateway remain different layers of the same payment flow where one protects data and the other transfers funds.

Also Read: Smart POS Systems

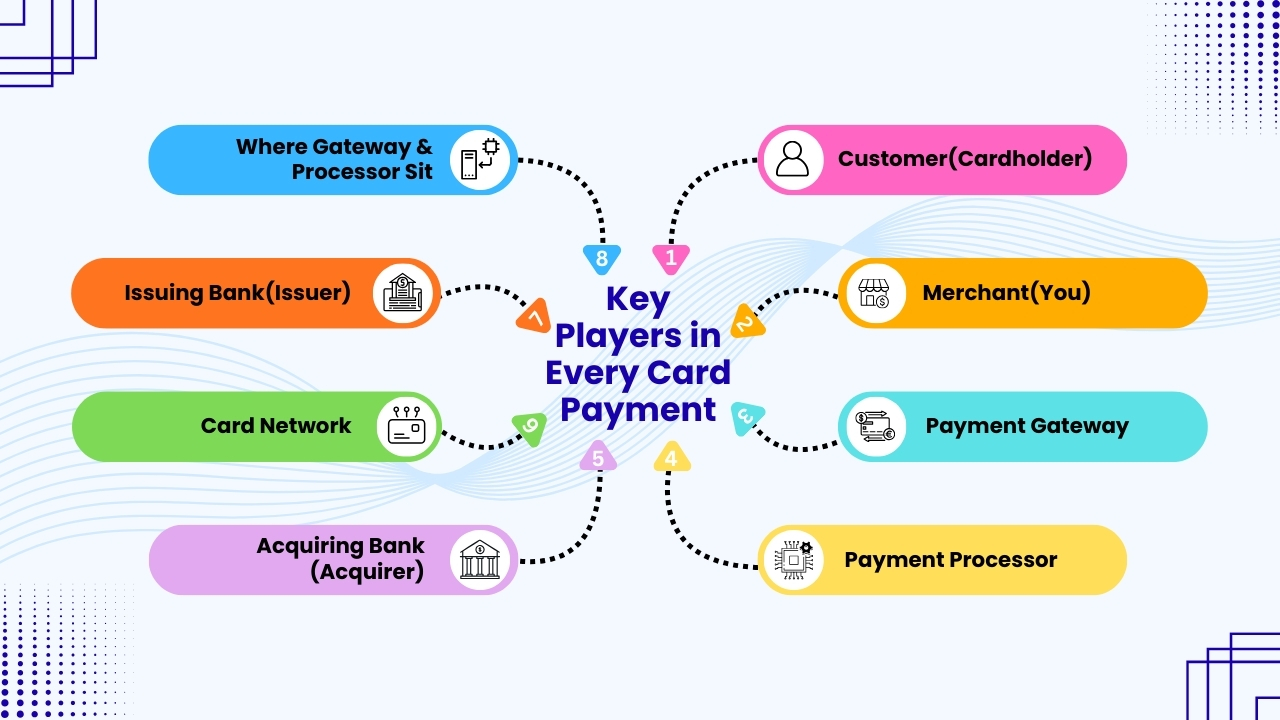

Key Players in Every Card Payment

Before we dive deeper, let’s quickly introduce all the important players involved in a usual card transaction:

1. Customer(Cardholder)

A customer is the person making the purchase with a credit or debit card. Their bank account or credit line ultimately funds the transaction.

2. Merchant(You)

Your business that accepts card payments for products or services. You depend on gateways, processors, and banks to get paid safely and on time.

3. Payment Gateway

It is the secure “front door” of the transaction. It captures card details on your website, app, or terminal and encrypts them. It sends this sensitive data safely into the payment ecosystem.

4. Payment Processor

Payment processor is the “traffic controller” that moves transaction data between banks and networks. It manages authorization, settlement, refunds, and sometimes chargebacks.

5. Acquiring Bank (Acquirer)

It is the bank that provides your merchant account. It receives card funds on your behalf and deposits them into your account.

6. Card Network

It sets the rules, fees, and standards for card transactions. It carries authorization requests between acquirers and issuers.

7. Issuing Bank(Issuer)

Your customer’s bank that issued their card. They check balance, risk, and fraud signals, and then approve or decline.

8. Where Gateway & Processor Sit

The gateway acts as the outer gateway between your store or app and the payments ecosystem. The processor acts as the middle, connecting acquirers, networks, and issuers.

Also Read: Restaurant Credit Card Processing

What a Payment Gateway Really Does?

The primary job of a payment gateway is to securely collect and transmit payment information from the customer to the processor or acquirer.

Think of it as:

- The checkout form on your website.

- The API that your mobile app calls to charge a card.

- The “Pay” button experience is embedded into your commerce flow which is a secure bridge between customer and processor.

- The core job of a payment gateway is to safely collect payment details from your customer and pass them to the processor or acquirer.

- It makes sure that the data is complete, valid, and protected at every step.

Payment Gateway acts as your digital checkout counter

- On a website, the payment gateway often powers the checkout form where customers enter card details or select websites such as Apple Pay, Google Pay, or UPI-style options.

- On a mobile app, it’s the API that the app calls in the background when a user hits “Pay”.

Payment gateway owns the “Pay” button experience

- Whether it’s a “Pay Now,” “Subscribe,” or “Complete Order” button, the gateway is usually behind the scenes handling that moment.

- It links together UI, validation, security checks, and communication with the processor.

Also Read: Retail Payment Platform

Key Functions of a Payment Gateway

1. Data Capture

- It collects card details such as card number, expiry date, and CVV in a secure way.

- It often captures billing addresses and sometimes addresses for AVS(Address Verification Service).

- It supports alternative payment methods like digital wallets, BNPL(Buy Now, Pay Later), local payment options, and sometimes bank transfers.

2. Tokenization

- It converts raw card data into a token which is a random looking string that your system can store and reuse.

- This means you never keep actual card numbers on your servers, massively reducing your exposure as if there is a breach.

- By not storing sensitive card data directly, your PCI DSS compliance scope reduces, saving cost and complexity for your business.

- Tokens enable things such as saved cards, recurring billing, and one-click checkout without exposing card details.

3. Encryption & Security

- Encrypts payment data in transit so that, even if intercepted, it’s unreadable.

- It often supports 3D Secure(3DS/3DS2) to add an extra verification step like OTP or biometric confirmation on higher-risk or cross-border transactions.

- May include built-in fraud tools like:

- Velocity checks(how many attempts from same card or device)

- IP geolocation checks

- Blacklist/whitelists

- Risk rules connected to your business(for instance, high-value orders, specific countries).

4. Routing Requests

- Sends the authorization request to the right processor or acquired based on your setup.

- Some advanced gateways do smart routing, for instance:

- Route EU cards to a European acquirer for better approval rates.

- Direct high-fee card types through processors that charge lower fees.

- Failover to another processor if the primary processor is down.

- This routing can improve approval rates, costs, and uptime.

5. Front-End Features & UX Tools

- Offer hosted payment pages, embedded checkout forms, or drop-in widgets so you don’t have to build everything from scratch.

- Supports saved cards, vaulted tokens, and one-click or one-tap checkout, which improves conversion and repeat purchases.

- Often includes multi-currency and multi-language support so you can sell globally with localized experiences.

- May integrate with subscriptions, invoicing, and billing tools for recurring revenue models.

Also Read: Contractor Payment Solutions

Types of Payment Gateways

1. Hosted Payment Gateway

A hosted payment gateway redirects customers from your site to a secure external checkout page, where they enter card or wallet details. Though it is easier to implement, it offers less branding control.

Advantages

- It is very easy to implement.

- The security burden is largely on the gateway provider

- It is good for small businesses or quick MVPs.

Disadvantages

- It offers less control over branding and UX.

- Customers may feel like they are leaving your site, which can negatively impact trust or conversions.

2. API / Direct Integration Gateway

With an API or direct integration gateway, the checkout form and payment experience live entirely on your site or app, while the gateway runs in the background via secure APIs, giving you full control over design, UX, conversion optimization, for your specific business model.

Advantages

- Full control over design, layout, and user journey.

- Can create highly optimized, conversion-focused checkout flows.

Cons

- It is slightly more complex to implement.

- You take on more responsibility for PCI compliance, through tokenization, client-side SDKs help reduce this.

3. Integrated All-in-One Platforms

Integrated all-in-one platforms bundle the gateway, processor, and merchant account into a single solution, so you sign up once and manage everything in one dashboard. Though for you, it behaves like one simple product, but behind there is still a gateway layer quietly handling data capture, tokenization, security, and routing for every transaction.

Advantages

- Simplified onboarding, pricing, and support.

- Fewer moving parts to manage and fewer vendor relationships.

Disadvantages

- Less flexibility to shop around for cheaper processors or specialized acquirers.

- You may be more dependent on a single provider’s ecosystem and options.

Also Read: Smart Payment Solution for Gaming and Esports

What a Payment Processor Really Does?

The payment processor’s main job is to move transaction data through the card networks and make sure that the right funds end up in your merchant account. It quietly takes care of the hard work of authorization, clearing, and settlement behind the scenes.

Payment Processor acts at the center of the payment ecosystem

While the payment gateway is facing the customer and focused on capturing payment details, the processor works behind the scenes, coordinating with card networks, acquiring banks, and issuing banks. It moves transaction messages back and forth so every authorization request gets a clear yes or no response.

Payment Processor acts as Operational engine for scale and reliability

The processor is the engine room of card payments, ensuring transactions are routed correctly, retried whenever needed, and settled on time. Its infrastructure keeps payments flowing smoothly and consistently, even as your volume grows across channels, markets, and payment methods.

Key Functions of a Payment Processor

1. Sending Authorization Requests

- Receives encrypted transaction details often via the gateway such as card number or token, amount, currency, merchant information and more.

- Routes the authorization request to the appropriate card network.

- The card network then forwards the request to the issuing bank such as the customer’s bank for a decision.

- The processor ensures the message is in the correct format and follows network rules and standards.

2. Receiving Approval/Decline Responses

- The issuing bank checks:

- Whether the card is valid and active.

- Whether there is enough credit or balance.

- If there are fraud or risk flags:

- The processor receives this response and passes it back through the card network and usually via the gateway to your checkout, POS, or app in real time.

- This is what determines whether the customer sees “Payment successful” or an error message.

3. Handling Settlement

- After a transaction is authorized and captured, the payment processor helps batch those transactions.

- It then works with the card networks and acquiring bank to:

- Clear the transactions(finalize them in the network).

- Settle funds into your merchant account at the acquiring bank.

- Along the way, it calculates and distributes interchange fees which are paid to issuers and network fees which are paid to card networks, often invisibly to you.

4. Managing Chargebacks and Disputes

- When a customer disputes a transaction, then a chargeback is raised by the issuer.

- The processor helps move evidence and messages between you(the merchant), the acquirer, and the issuer.

- It may provide tools for you to:

- Upload receipts, invoices, and proof of delivery

- Track chargeback statuses and deadlines.

- Monitor chargeback ratios to stay within acceptable limits

- Good processors also offer risk and dispute management guidance to keep your account in good standing.

5. Reporting & Reconciliation

- Generates detailed transaction logs, statements, and summary reports.

- Total processed volume

- Fees(interchange, network, processing)

- Refunds, chargebacks, and adjustments

- Helps your finance and accounting teams reconcile:

- Daily or weekly payouts

- Individual transactions

- Fees versus revenue

Also Read: How to Build Payment Franchise With Ace Merchant Processing

Payment Gateway vs Payment Processor

Below is a simple comparison between Payment Gateway and Payment processor:

1. Payment Gateway = Secure Entry Point

- It is a technology faced by customers that captures and securely transmits payment data.

- Think: checkout form, “Pay Now” button, API your app calls.

2. Payment Processor = Transaction Engine

- It is a back-end service that routes, authorizes, clears, and settles transactions.

- It coordinates with card networks, acquiring banks, and issuing banks to push each payment through and move the funds.

What a Payment Gateway Does (Role & Responsibilities)

1. Customer-Facing Capture Layer

- It provides the payment form or widget on your website, app, or POS.

- Handles card entry, wallet selections like Apple Pay or Google Pay, and alternative methods like BNPL, bank debit.

2. Security & Compliance Shield

- It encrypts payment data in transit so card details are not exposed.

- Uses tokenization to replace card numbers with non-sensitive tokens you can safely store.

- Reduces your PCI DSS scope, since raw card data never touches your servers or touches them minimally.

3. UX & Conversion Boost

- Offers hosted pages, drop-in forms, or fully customizable APIs.

Enables saved cards, one-click checkout, and localized experiences like currency and language. - Affects conversion rate directly like loading speed, design, error messages, and mobile experience all live here.

- Enables saved cards, one-click checkout, and localized experiences like currency and language.

- Affects conversion rate directly like loading speed, design, error messages, and mobile experience all live here.

4. Smart Routing (Advanced Gateways)

- Send EU cards to a European acquirer.

- Use alternative processors for specific card types or risk profiles.

- Can improve approval rates and reduce costs when configured well.

Also Read: Hospitality Merchant Services for Hotels and Resorts

What a Payment Processor Does (Role & Responsibilities)

1. Core Transaction Handling

- Receives transaction data(often from the gateway)and formats it for card networks.

- Sends authorization requests through Visa or Mastercard and more to the issuing bank.

2. Authorization & Responses

- The issuer checks card validity, balance or credit, and fraud risk.

- Returns and approval or decline and a response code.

- The processor passes this response back usually via the gateway to your checkout in real time.

3. Clearing & Settlement

- It groups finished transactions together and forwards them for clearing and final settlement.

- Coordinates with the acquiring bank so funds land in your merchant account and then get paid out to your business bank account.

- It calculates and passes along interchange and network fees in the background.

4. Chargebacks, Disputes & Risk

- Manages the message flow of chargebacks between you, the acquirer, and the issuer.

- It provides portals or reports where you can submit evidence and track disputes.

- Manages the message flow of chargebacks between you, the acquirer, and the issuer.

- Provides a portal or reports where you can submit evidence and track disputes.

- Monitors chargeback ratios, flags risky patterns, and may impose risk rules or reserves.

5. Reporting & Reconciliation

- Generates detailed statements, logs, and exports for all transactions.

- It breaks down fees, refunds, chargebacks, payouts, and net amounts.

- It helps your finance team reconcile about what you sold versus what actually hit your bank.

Key Differences at a Glance

1. Where They Act in the Flow

- Payment Gateway: acts at the front between your store or app and the payment ecosystem.

- Payment Processor: acts in the middle between gateway or acquirer and card networks or issuers.

2. What They Handle

- Payment Gateway: handles data capture, encryption, tokenization, checkout UX, routing.

- Payment Processor: handles authorization, settlement, chargebacks, reporting, money movement.

3. Who They Interact With Most

- Payment Gateway: interacts with your developers, designers, and product team because of UX and integration.

- Payment Processor: interacts with your finance, operations, and risk teams because of fees, payouts, and disputes.

4. Impact on Your Business

- Payment Gateway: heavily influences conversion, customer experience, and PCI scope.

- Payment Processor: determines approval rates, cost structure, payout timing, and risk management.

When They’re Separate vs Bundled

How it works

You intentionally choose different partners for each layer:

- Payment Gateway for checkout UX, tokenization, and routing.

- Payment Processor for transaction handling and pricing.

- Acquirer for your merchant account and settlements.

Advantages

- High flexibility: You can optimize each layer independently for UX, approval rates, and costs.

- Easier to switch processors: If pricing or performance changes you can change the processor while keeping the same gateway and frontend.

- Advanced routing: The gateway can send traffic to multiple processors based on region, card type, or risk profile.

Disadvantages

- More integration work: Your technical team must handle more APIs, webhooks, and reconciliation logic.

- More relationships to manage: Separate contracts, invoices, and support teams for gateway, processor, and acquirer.

All-in-One Platforms

How it works

Gateway, processor, and an aggregated merchant account are bundled into a single product with one signup.

Advantages

- Fast onboarding and go-live.

- Simple pricing and one dashboard for payments, disputes, and payouts.

- Lower operational overhead for small and mid-sized teams.

Disadvantages

- Offers less granular control over interchange optimization, risk rules, and routing logic.

- Potentially higher effective fees once your volume is large enough to negotiate directly with processors and acquirers.

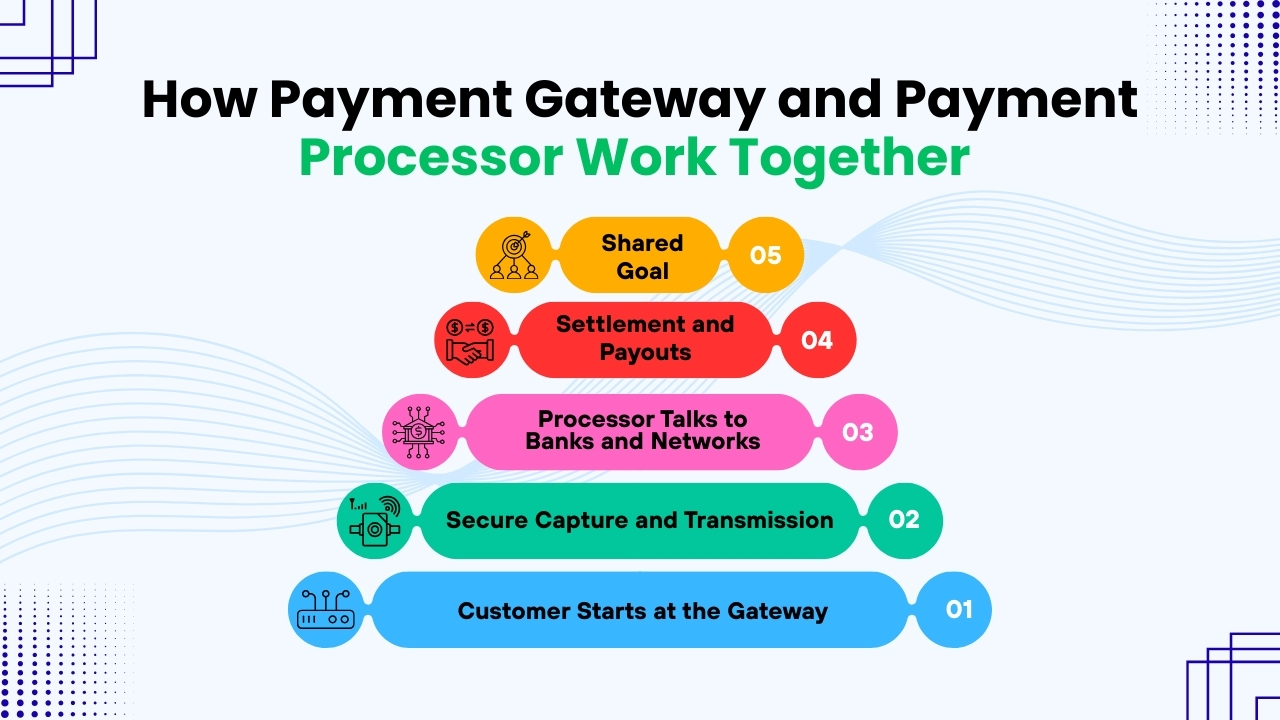

How Payment Gateway and Payment Processor Work Together

1. Customer starts at the gateway

- The flow begins when a customer enters card or wallet details on your website, app, or POS, and clicks “Pay.”

- The payment gateway then empowers this checkout experience, validating inputs and handling errors for instance, wrong card number format.

2. Secure capture and transmission

- The gateway encrypts sensitive details and often converts them into a token so raw card data never touches your servers.

- It then packages the transaction like amount, currency, merchant information, and sends it to the payment processor.

3. Processor talks to banks and networks

- The payment processor forwards the request through the card network to the issuing bank.

- The issuer checks card validity, balance, and fraud risk, and then returns an approve or decline response.

- The processor passes this response back usually via the payment gateway to your checkout in real time.

4. Settlement and payouts

- For approved transactions, the payment processor later batches, clears, and settles funds into your merchant account.

- The gateway may show receipts, status, and saved-card options to the customer.

5. Shared goal

Together, payment gateway and payment processor turn a secure click on “Pay” into funds safely deposited into your business bank, with a smooth UX and compliant money movement.

Conclusion

Ultimately, a payment gateway and a payment processor are not competitors; rather they are partners in the same journey from “Pay Now” to money in your account.

Where the payment gateway acts at the front of the payment journey. It owns the checkout experience, captures, and encrypts sensitive card data, handles wallets, and alternative payment methods, and often manages tokenization and 3D Secure. It’s what your customer “feels” when they pay for the form design, error messages, speed, and ease of use.

The payment processor acts behind the scenes. It coordinates with the card networks, acquirers, and issuers, gets approvals or declines, batches transactions, and settles funds into your merchant account. It also manages the messy realities of chargebacks, disputes, and detailed reporting so your finance and risk teams can keep everything under control.

Sometimes roles of both payment processor and payment gateway are split across multiple partners while sometimes they are bundled into a single all-in-one platform. In the early stage, that all-in-one approach is usually the smartest move with less friction, faster launch, fewer vendors.

As your volume, geography, or risk profile becomes more complex, it may make sense to separate layers keeping a flexible gateway while optimizing processors and acquirers for cost, approvals, and resilience. The key is understanding what each layer does so you choose, and later refine, a payment stack that matches how you actually do business.

If you still have any query regarding payment gateway versus payment processor, then feel free to write to us at Ace Merchant Processing and we are more than happy to assist you.