Introduction

The future of retail payments is often shaped by frequent innovation due to changing customer expectations, and the rise of digital-first technologies. Traditional checkout methods are always giving way to smarter, faster, and secure solutions which redefine the retail checkout experience.

Today’s consumers expect smooth transactions whether they pay with a modern payment terminal, mobile payment terminal, or through cloud-connected payment terminal options which integrate directly into broader retail POS systems.

Modern payment terminal features like contactless payment support, multi-payment POS support, and digital receipts with mobile wallet support are now standard for retailers who are aiming to improve convenience and efficiency.

More businesses are increasingly depending on integrated POS solutions with retail analytics integration to better understand customer purchasing behavior, while POS terminals with inventory management which ensures real-time synchronization between sales and stock.

While factors like security and compliance remain critical, secure payment processing like Ace Merchant Processing ensures sensitive data is protected. A PCI DSS compliant terminal with secure payment processing protects sensitive data, while EMV and NFC support provides more protection and flexibility.

If you are a forward-looking retailer, then they include smart payment solutions for retailers for POS system customization which allows branding and personalization that improves customer trust and loyalty.

As the shift is clear: retail payment technology is no longer just about completing a transaction. Rather it is about creating a customer-friendly POS terminal experience which combines speed, mobility, and security.

As we explore the next decade, the best payment terminals for retailers will be those that integrate innovation with adaptability, making it the way for a smarter future in retail payments.

The Payment Landscape Today

With the world of retail payments changing frequently due to technology, consumer expectations, and the need for smooth and secure transactions. So, modern retailers cannot just depend on cash or card-only systems, rather need to support many payment options which bring convenience, innovation, and trust.

Below are five important aspects for shaping the future of retail payments:

1. Contactless and Mobile Wallets:

Due to its fast, secure tap-to-tap transactions, contactless and mobile wallets will ensure that customers will have smooth checkout experiences and also improve their conveniences in order to make payments.

2. Omnichannel Integration:

As such integration ensures payment systems connect like-in store, online, and mobile purchases, which lets customers experience a smooth and unified shopping experience.

3. Security and Compliance:

Due to the cases of cyber threats increasing everyday it is essential for retail payments to offer security and compliance so retailers require to provide advanced protection.

By implementing end-to-end encryption will secure sensitive data and tokenization replaces card details with secure tokens.

It is only by adhering to PCI DSS standards that you can ensure compliance which will gain customer trust and improve the overall safety of payment transactions.

4. BNPL and Flexible Payments:

Such flexible payment options are changing the retail sector because the customers have greater control over their spending.

It lets shoppers split purchases into smaller, interest-free installments rather than paying the full amount upfront. Because of this flexibility, higher value items become more affordable to the customers and also improves their overall shopping experience which leads to repeat purchases and customer loyalty.

Retailers who provide BNPL solutions to their customers will reduce chances of any cart abandonment from customers which will attract more buyers and increase conversion rates.

5. Data-Driven Insights:

Modern payment terminals are also data centers that not just complete payments but can also capture insights about customer behavior and purchasing patterns.

By analysing such data, retailers get to identify trends, predict demand which help them to customize their promotions that increase customer engagement rates.

Integrated analytics will help retailers to manage their inventory effectively to ensure that they have popular items in stock and reduce waste.

On top of that such insights helps retailers to give personalized offers which lets retailers to give good loyalty programs improving sales, customer satisfaction, and improving business performance.

Before planning ahead, it’s essential to recognize where we stand today.

- Cash is declining but still is used for small transactions in emerging economies.

- Credit and debit cards remain dominant but are mostly linked to mobile wallets.

- Digital wallets like Apple Pay, Google Pay, Alipay are now widely used and accepted.

- By making larger purchases more affordable, BNPL options are making larger purchases more affordable.

- Cryptocurrencies and blockchain technologies have started to explore more adoption in everyday transactions.

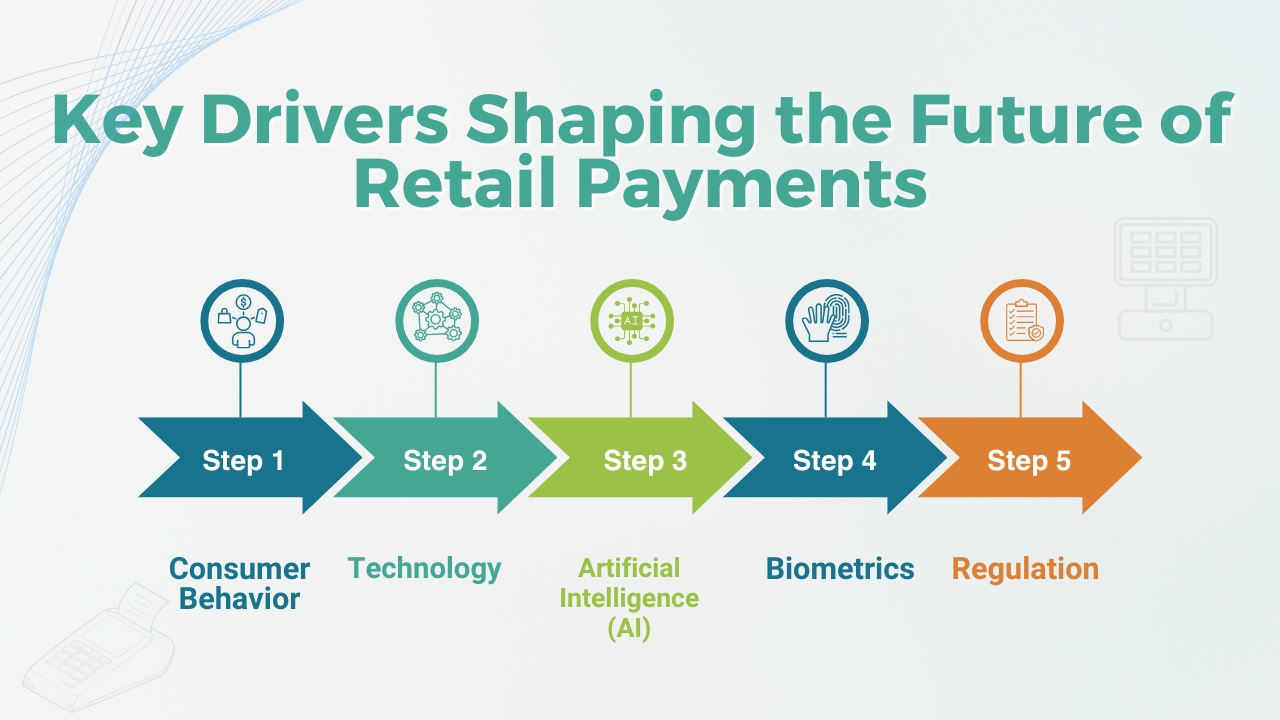

Key Drivers Shaping the Future of Retail Payments

Due to continuous innovation, changing customer expectations, and technological advances, the retail sector is changing frequently. And the businesses who understand such forces will only be able to succeed in this competitive market.

Below are three key drivers shaping the future of retail payments.

1. Consumer Behavior:

- For today’s shoppers convenience comes first and they expect one-tap checkouts, immediate confirmations, and smooth digital transactions which will save time, reduce friction, and deliver a smooth payment experience which keeps them engaged and satisfied with every purchase.

- It is important to deliver the same, smooth, dependable checkout experiences across stores, apps, and online to build trust and convenience across every channel.

- Customers look for retailers who provide security and protect their data. So it is essential for retailers to adopt different fraud prevention measures like encryption, tokenization, and real-time monitoring which ensure safe transactions across every payment channel.

2. Technology:

- With the increase in the use of 5G and IoT technologies, retail payments have become faster and real-time transaction verifications.

- Due to low response times and smooth connectivity retailers are able to process payments instantly. Customers enjoy smooth, reliable, and secure experiences across physical and digital channels due to faster checkouts and modern payment options.

- Due to better checkout efficiency, innovative payment methods, customers are getting smooth, reliable, and secure experiences in physical and digital channels.

3. Artificial Intelligence(AI):

- Artificial Intelligence(AI) has changed retail payments by offering advanced fraud detection, offering deep customer insights, and dynamic checkout experiences.

- With real-time analysis, such AI systems can detect suspicious activity instantly. Retailers are also able to personalize customer interactions and smooth processes while letting them improve security, sales, by providing customer-specific payment options by adapting to changing shopping behaviors.

4. Biometrics:

- Biometrics includes authentication via fingerprint scanning, facial recognition, and voice identification. It is slowly replacing traditional PINs and passwords in retail payments.

- Using such advanced methods improve security, speed up transactions, and reduce fraud risks which lets customers experience a smooth, convenient, and personalized checkout experience.

5. Regulation:

- Retailers have to adhere to strict PCI DSS compliance so they have to adopt stronger encryption, tokenization, and monitoring to secure payment data and protect customers from fraud and data breach.

- Governments worldwide are promoting digital-first economies through initiatives like India’s UPI and the EU’s PSD2 increasing secure, smooth, and cashless payment ecosystems for both businesses and consumers.

- Payment systems are built as per data privacy laws to ensure secure handling of personal information which lets businesses offer transparency, consent, and customer trust.

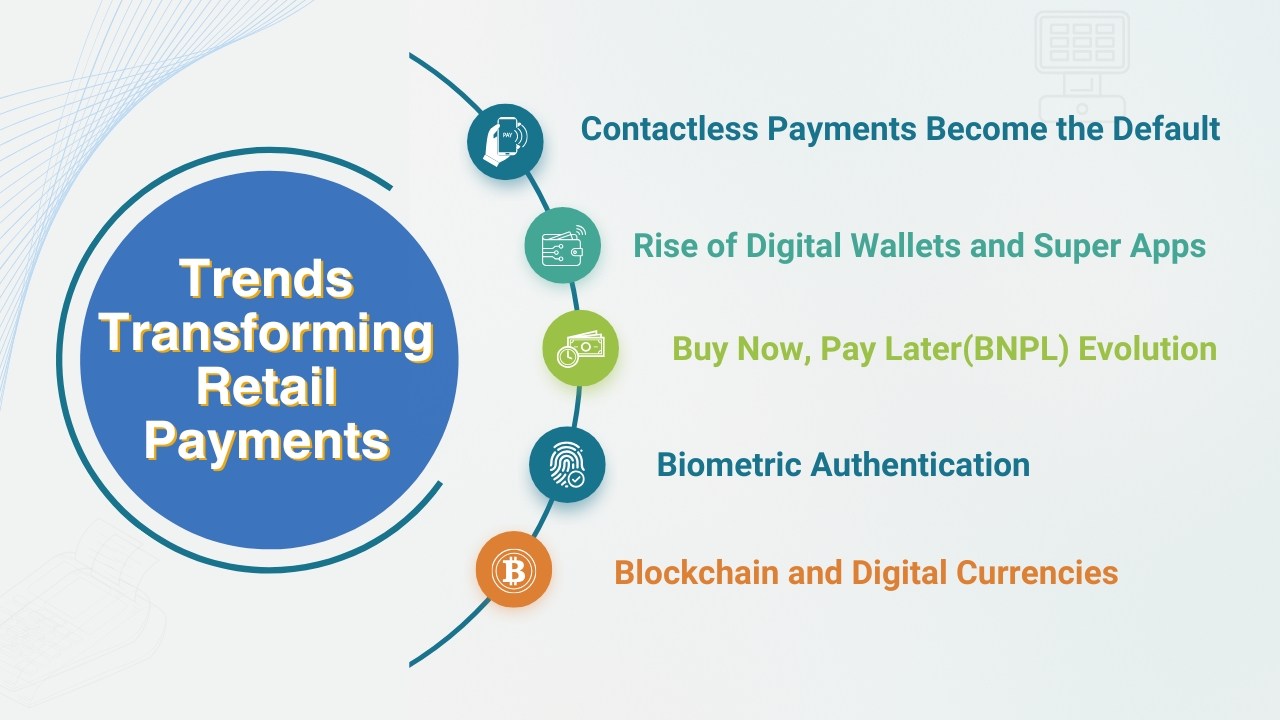

Trends Transforming Retail Payments

Retail payments are changing frequently because of technology, consumer expectations, and regulatory changes. With the increase in the use of digital wallets, BNPL options, Artificial Intelligence, biometrics, and blockchain, retailers are adopting new payment options which allows them to offer smooth, secure, and personalized payment experiences to their customers.

Such innovations allow customers to make payments as per their convenience and also provide insights to business and strong fraud prevention tools. So it is essential for retailers to know such trends to stay competitive in the fast ever changing digital economy.

1. Contactless Payments Become the Default:

Contactless payments are becoming the default offering speed, safety, and convenience as most of the customers prefer tapping cards or mobile wallets over cash or traditional swipe methods.

2. Rise of Digital Wallets and Super Apps:

Platforms like WeChat, Paytm, CashApp have grown from simple wallets into super-apps where users get to shop, pay, invest, and order food in one place. So retailers must integrate with such super apps in order to stay valid or risk losing access to large and engaged customer bases.

3. Buy Now, Pay Later(BNPL) Evolution:

Buy Now, Pay Later(BNPL) is growing gradually allowing shoppers to make flexible payments with interest-free installments helping retailers. It allows retailers to increase conversions, attract younger customers, and transform purchasing behavior in the competitive retail environment.

4. Biometric Authentication:

Biometric authentication, using fingerprint, facial recognition, or voice ID, is changing retail payments because they are replacing passwords and PINs with faster, more secure methods. It improves convenience, reduces fraud, and strengthens customer trust at checkout.

5. Blockchain and Digital Currencies:

Blockchain and digital currencies are changing payments by allowing faster and transparent transactions. Because the rising interest in cryptocurrencies is prompting retailers to explore blockchain payments which improve security, reduce costs, and offer new ways to pay.

Future Retail Payment Models

The future of retail payments are evolving toward smooth, secure, and highly personalized experiences. So most of the customers will depend on digital wallets, BNPL services, and biometrics which lets them make faster and safer transactions.

Super apps like WeChat and Paytm will integrate shopping, payments, and financial services into one ecosystem. Blockchain and digital currencies will introduce decentralized alternatives, while AI-driven insights will maximize fraud prevention and personalize checkout flows.

While Governments will promote digital-first economies with regulations like PSD2 and UPI. So payment options will become more customer-centered, data-driven, and multi-channel which lets customers make payments as per their conveniences and gain their trust and loyalty.

1. Amazon Go Model:

In the Amazon Go model, customers simply enter, grab their items, and exit, while the payment is smoothly completed in the background.

2. Smart Carts and IoT Sensors:

Smart carts and IoT sensors track items as you shop which enable smooth checkout without any traditional cash registers.

3. Voice-Activated Payments:

Such payments allow customers to use simple voice commands through Alexa or Google Assistant which lets them complete purchases hands-free, faster, and securely for a smooth checkout.

4. Subscription-Based Shopping:

Subscription-based shopping lets customers receive products regularly because of automated payments. It offers convenience, personalization, and cost savings, which helps retailers to develop predictable revenue, strengthen customer loyalty and improve long-term engagement with their brand.

5. Global Cross-Border Retail Payments:

Global cross-border retail payments have become fast and more efficient because of digital wallets, blockchain, and fintech platforms for smooth transactions.

Such innovations reduce fees, improve transparency, and make it easier for retailers to provide services to international customers with secure, convenient payment options worldwide.

Challenges Ahead:

While retail payment methods are changing frequently, businesses are experiencing hardships with emerging challenges which demand them to adopt innovation and stronger security measures to stay competitive.

The shift is toward digital and data-driven systems that introduce complexities that impact security, trust, compliance, and infrastructure. While there are many opportunities, it is only by overcoming these obstacles will determine whether retailers flourish in the next era of commerce.

1. Security and Fraud:

Because of most transactions completed online and across multiple digital channels, the risk of cyberattack and fraud has considerably increased. With phishing scams, account takeovers, and payment credential theft are some of the threats that retailers face.

AI-driven fraud detection is emerging as a critical defense in order to resist such risks. AI also gets to learn from transaction patterns in real time, quickly identifying inconsistencies which suggest fraudulent activity.

Machine learning algorithms can assess thousands of variables such as location, device type, transaction frequency in seconds. It helps to identify high-risk activity without interrupting legal customers.

So it is essential for retailers to continuously update security protocols by investing in encryption and tokenization and work with trusted payment providers like Ace Merchant Processing. So with strong authentication like multifactor verification and biometrics will be essential to reduce fraud.

2. Consumer Trust:

Trust is important in every payment transaction. While the payments become more digital and automated, concerns around privacy and data use are increasing.

For instance, biometric payments offer speed and convenience but often consumers have queries like whether their stored face data and fingerprint can be misused or hacked.

Retailers cannot ignore such concerns as transparency is critical. Customers want to not just know that their data is secure but also how it is being collected, used, and shared. So clear communication of data policies, easy opt-out options, and compliance with privacy laws like GDPR and CCPA are essential to maintain trust.

3. Regulation:

The future of retail payments is influenced by regulations as governments impose strict rules on Buy Now, Pay Later and cryptocurrencies.

So retailers have to take quick action in order to ensure compliance with changing standards by adopting secure, transparent systems.

Proactive adaptation will help businesses to maintain customer trust and avoid costly legal or financial setbacks.

4. Infrastructure Gaps:

Infrastructure gaps will influence the future of retail payments mainly in developing regions. Because of low internet connectivity, regular network outages, and less financial knowledge may slow down adoption of digital systems.

Even the most advanced payments cannot operate to its full potential without strong infrastructure. Retailers have to make investment in stronger digital infrastructure, increase financial education, and develop payment innovations to support continuous growth.

What Retailers Must Do to Prepare:

Step 1: Invest in Omnichannel Payments:

For customers to enjoy consistent convenience, it is important for modern retail payments to ensure smooth and continuous in-store experiences, mobile apps, websites, and third party marketplaces.

So retailers have to integrate channels which will improve loyalty and create a unified shopping that adapts to changing consumer preferences and expectations.

Step 2: Adopt Secure and Flexible Terminals:

It is important for retailers to support EMV chip cards, NFC contactless payments, QR code scanning, and digital wallets which will ensure retailers accept different payment methods.

Such flexibility not just improves customer convenience but also makes businesses modifiable against changing technologies and changing consumer preferences in the retail sector.

Step 3: Explore Partnerships with FinTechs:

As retailers cannot create every payment innovation so it is essential for retailers to work with fintechs, banks, and technology providers to speed up adoption.

Such strategic partnerships will allow faster integration of advanced solutions, reduce expenses, and ensure retailers stay both competitive while also meeting consumer expectations in digital environments.

Step 4: Train Teams and Educate Customers:

Adoption of just new payment technologies is not just essential but also gaining customer trust and making customers feel safe while using them.

For successful adoption retail payments require transparency, education, and user-friendly design, which will help customers to adopt new innovations and make technology a part of everyday shopping experience.

Essential Learnings:

- The future of retail payments is digital, mobile, contactless, and increasingly invisible.

- So retailers have to make investments in flexible, secure, customer-friendly payment solutions such as Ace Merchant Processing for success.

- Regulation, trust, will surely describe the speed of adoption.

- The next decade will surely see a retail payment option that blends AI, biometrics, blockchain, and mobile ecosystems which will change the retail payment systems and how we pay.

Conclusion:

The future of retail payments will be transformed because of constant innovation, changing customer expectations and global digital transformation. So now shoppers look for faster, safer, and convenient payment options.

It is essential for retailers to provide smooth payment experiences across in-store, online or through mobile platforms. Retailers also have to deliver consistent experiences across every channel which will keep customers satisfied.

Retailers must also adopt strong security and compliance features like end-to-end encryption, tokenization, and PCI DSS standards. It is only by offering strong security and compliance that helps retailers to gain customer’s trust by protecting sensitive data of customers.

At the same time, collaboration among retailers, banks and networks is important. As retailers can’t build everything themselves, it is important to partner with fintech companies, banks, and technology providers which helps them to speed innovation and enables faster integration of contactless, QR, and digital wallet payments.

But to an extent, the success of such technologies depends on people, and not just systems. In order to ensure widespread adoption, build consumer confidence with transparency, education, and intuitive design. It is only by addressing infrastructure gaps in emerging markets will shape how inclusive and worldwide this shift becomes.