Introduction:

Retail payment trends are changing at a lightning speed, transforming how customers shop and how businesses operate. So what once mostly retail payments were done using cash and card swipes has shifted to digital wallets, contactless payments, and Buy Now, Pay Later(BNPL) solutions which provide speed and convenience.

As the expectations of customers keeps increasing, retailers must embrace new innovation which offers smooth, secure, and personalized checkout experience if it is for online and in-store.

Today, the payment is often driven by mobile-first shopping, omnichannel integration, and real-time payment systems that would allow transactions to do anytime and anywhere.

So shoppers expect smooth options from tapping their phones at checkout, splitting their payments through BNPL platforms often demanding strong security and data protection.

Shoppers expect smooth options from tapping their phones at checkout to splitting payments through BNPL platforms while demanding strong security and data protection.

While AI in payments, blockchain technology, and biometric authentication are redefining transparency, trust, and security in retail commerce.

For retailers who are staying ahead of these trends is no longer optional but it is essential to compete in a digital-first economy. So those who adapt quickly will not just increase sales but also develop stronger loyalty by offering the flexibility and innovation that consumers look for.

This blog will walk you through the most retail payment trends which are shaping 2025 and beyond, and how businesses can prepare for the future of commerce.

Also Read: Top 5 Features Every Retailer Should Look into a Modern Payment Terminal

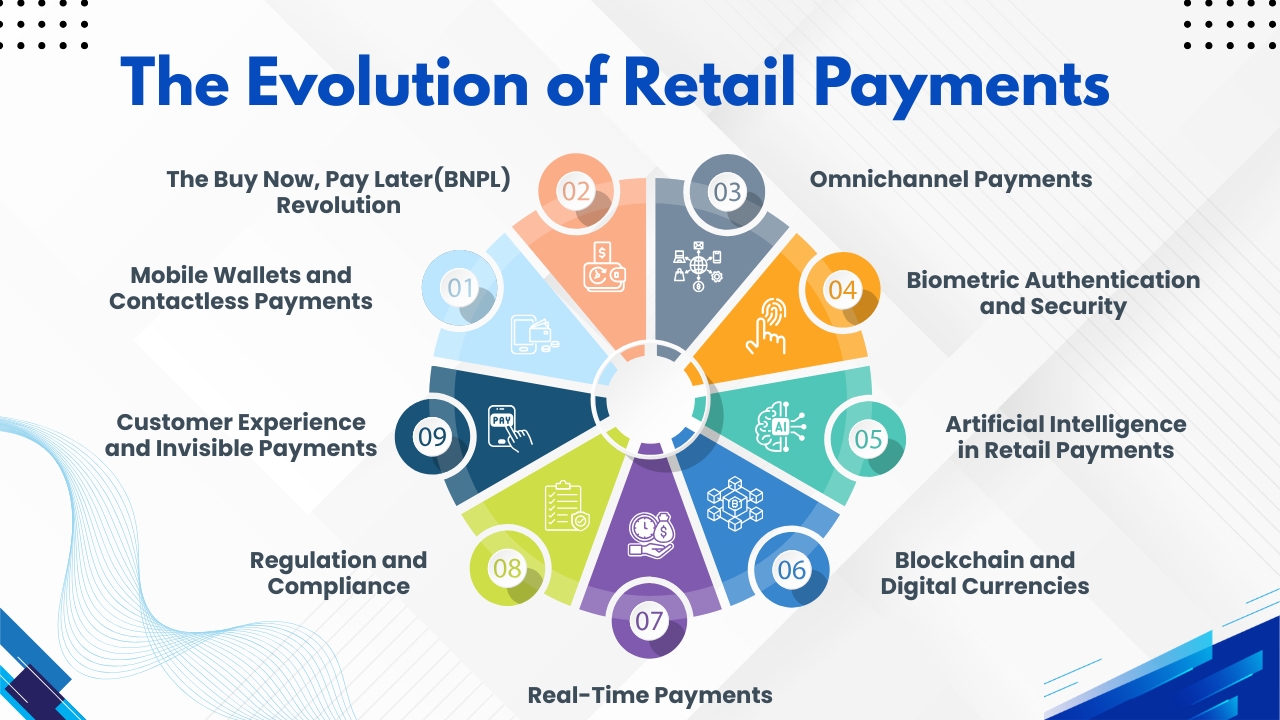

The Evolution of Retail Payments:

For many centuries, payments were done by barter system, coins, and paper money. While with the introduction of checks and bank transfers offer greater conveniences to the customers.

In the 20th century, with the arrival of credit and debit cards has transformed retail, offering a universal payment method that is accepted all over the world.

During the 1990s and 2000s, the rise of e-commerce introduced payment gateways like PayPal, Authorize. Net, and Stripe which enable retailers to accept online transactions securely and consumers to shop from anywhere in the world. Then, consumers became more comfortable to enter card details online.

The mobile revolution started in the 2010s when smartphones became powerful shopping and payment tools due to the adoption of mobile phones, digital wallets, and on-the-go transactions.

Then smartphones became their personal banking tools that gave them loyalty payments, and personalized offers. Meanwhile, retailers started using omnichannel payments to connect online and to do in-store shopping giving them a smooth payment experience.

Also Read: The Future of Retail Payments

Today, the retail payment journey is influenced by:

- Digital-first consumers who value speed and convenience.

- Europe implemented regulations like PSD2 that introduced strong customer authentication which required extra verification steps to make digital payments more secure.

- With the globalization of payment systems, India’s UPI and China’s Alipay have made possible fast and convenient digital transactions accessible to millions all over the world.

- Advancements in AI, blockchain, and biometrics which are driving new levels of speed, security, and innovation in retail payments.

So today retail payments are not about just simple transactions rather offer personalized experiences to customers due to which it plays an important role in shaping how customers view a brand.

1. Mobile Wallets and Contactless Payments:

One of the most seen trends in retail payments is the increase in the use of mobile wallets. Solutions like Apple Pay, Google Pay, and Samsung Pay allow their customers to store their multiple cards securely on their devices and also to make quick tap-to-pay transactions.

After the COVID-19 pandemic, hygiene became an utmost priority for everyone due to which users started considering contactless payments instead of cash or physical cards. According to a recent Mastercard survey, 80% of consumers worldwide now use contactless payments and this trend is expected to keep growing.

Key drivers include:

- Convenience: Tap-and-go payments are faster than inserting a chip or typing a pin.

- Security: Tokenization secures payments by replacing actual card details with non-sensitive tokens during each transaction.

- Integration: Mobile wallets easily connect with loyalty programs and rewards due to which it is easy for customers to use at checkout.

In Asia, QR code payments are very common while apps like WeChat Pay and Alipay allow people to pay bills, shop, book trips, and invest all in one place. While in the U.S. and Europe, NFC tap-to-pay is quickly replacing cash.

A recent retail study shows that Starbucks mobile app is one of the most successful payment platforms that combines ordering, payments, and loyalty points which accounts for over 25% of U.S. in-store transactions.

2. The Buy Now, Pay Later(BNPL) Revolution:

The Buy Now, Pay Later is changing the way retail payments are made by offering consumers more flexibility and control at checkout. It allows shoppers to split their purchases into smaller installments over weeks or months, often with less or no interest rather than paying the full price upfront.

Many popular providers like Klarna, Afterpay, and Affirm have gained popularity most among millennials and Gen Z who prefer financial solutions which fit into their budgets.

BNPL offers many benefits because by reducing the upfront cost, encourages customers to complete purchases rather than abandon their carts. A recent study shows that merchants offering BNPL can experience higher conversion rates and larger average order values.

For instance, Klarna reports up to a 41% increase in basket size when BNPL is available.

However, BNPL options also come with challenges as such options often encourage overspending and contribute to hidden consumer debt which may lead regulators to discover stricter guidelines. Despite such concerns, BNPL continues to grow as it provides an option between traditional credit cards and cash.

In the near future, BNPL is expected to become more integrated into mainstream banking and retail ecosystems making it an important part of modern payment methods.

Why BNPL is growing so fast:

- Affordability: Customers can buy expensive items in installments with less or no interest rather than paying upfront cost.

- Flexibility: Due to short-term installments, it becomes easier for customers to manage.

- Higher sales: Retailers often report increased basket size and reduced cart abandonment.

3. Omnichannel Payments:

The increase in the use of omnichannel payments is one of the most important retail payment trends seen today. This type of payment allows a smooth connection between online, mobile, and in-store transactions.

Because of such payment options, buyers get the same experience while they browse online, pay in-app, pick up in-store, or return items without any inconveniences. So it is important for retailers to adopt omnichannel payment options and give different options like Buy Online, Pickup in Store, or mobile checkout.

It helps retailers to gain the trust and loyalty of customers because customers may feel they are in control of how and where they complete their purchases.

It also helps retailers to get access to valuable insights. Because integrating payments across different platforms, allows retailers to analyze purchase behavior, deliver personality offers, loyalty rewards, and smooth checkouts.

Big retailers like Amazon Go’s walk-out payment system and Target’s app-based pick up are raising expectations with walk-out checkout and app-based in-store pickup.

Ultimately, omnichannel payments makes shopping easier and more flexible for customers because of smooth transactions throughout the payment process.

Retailers are adopting omnichannel payment strategies which allows customers to:

- Buy online and pick up-in store

- Begin shopping on a mobile device and finish the purchase in-store.

- Bring back items bought online and return them at a physical store.

Also Read: Smart POS System the Secret of Faster Checkouts and Happier Customers

4. Biometric Authentication and Security:

Biometrics are transforming retail payments by offering fast, more secure checkouts both in-store and online. Such payment uses fingerprint, face, or voice for authenticating users.

So instead of depending on traditional passwords or PIN codes, biometric systems use unique physical characteristics like fingerprints, facial recognition, iris scans, or even palm prints to verify identity. It makes the checkout process more secure while also improving convenience for shoppers.

For instance, Apple’s Face ID and Touch ID, which are widely used for mobile payments, and Amazon One, which allow customers to pay by simply scanning their palm.

Such innovations reduce frauds while delivering a smooth payment experience which matches the consumer’s demand for speed and simplicity.

While the increase in the use of biometrics can lead to privacy and regulatory challenges. Collecting and storing sensitive biometric data must adhere to global regulations like GDPR in Europe and CCPA in California, ensuring that personal information is protected.

So retailers adopting biometric payment systems need strong data security policies and transparent communication in order to build trust with customers.

Overall, biometric authentication is set to play an important role in the future of retail payments, balancing security, efficiency, and user confidence in the digital economy.

Examples include:

Voice-activated payments via Alexa or Google Assistant.

Though biometrics reduce fraud but raise concerns over data privacy. So. retailers that adopt biometrics must invest in transparent policies and customer trust.

5. Artificial Intelligence in Retail Payments:

Artificial Intelligence(AI) is reshaping retail payments by offering greater speed, security, and personalization to every transaction. For retailers, AI is not just a tool for fraud prevention but a driver of smarter customer experiences at the checkout.

One of the most powerful uses of AI in retail payments is detecting and preventing fraud. Traditional systems depend on static rules, but AI can analyze millions of transactions in real time, identifying unusual behavior or high-risk activities instantly.

It helps to prevent fraudulent charges while also avoiding false declines that often frustrate shoppers and impact sales. Beyond security, AI is creating personalized payments. It is only by studying customer purchase histories, AI can recommend the best payment methods, apply discounts or loyalty rewards automatically, or even suggest Buy Now, Pay Later(BNPL)options which are well suited to each shopper’s profile. This not just improves convenience but also builds long-term loyalty.

AI supports chatbots and virtual assistants that assist customers at checkout, handle payment questions, and deliver quick support. Major payment networks like Visa and Mastercard use AI-powered decision engines in order to speed up approvals and minimize delays.

As digital transactions grow, AI will continue to transform retail payments into a predictive, intelligent system where security, efficiency, and customer satisfaction work hand in hand.

Its main roles include:

- Fraud detection: AI systems identify unusual spending behaviors instantly as transactions occur.

- Personalized offers: Retailers can offer personalized discounts directly during checkout.

- Chatbots and voice assistants: Chatbots and voice assistants help customers during payments by answering questions, resolving issues, offering guidance, and ensuring a smooth, convenient checkout experience across different retail channels.

Mastercard Decision Intelligence uses AI to analyze cardholder behavior and prevent false declines while reducing fraud.

AI enables dynamic pricing and predictive analytics, allowing retailers to predict demand and customize payment options to better suit customer preferences.

6. Blockchain and Digital Currencies:

Blockchain and digital currencies are reshaping the future of retail payments by offering transparency, speed, and security which traditional systems often lack.

Unlike traditional payment networks, blockchain uses a decentralized ledger which makes transactions permanent and lowers the risk of fraud or changes. It creates greater trust between retailers and consumers.

Cryptocurrencies like Bitcoin and Ethereum have gained popularity as an alternative payment method, allowing shoppers to make purchases without depending on banks or credit card networks.

Although price unpredictability is a challenge, stablecoins like USDC and Tether are backed by fiat currencies which is a steadier option for daily retail payments.

For retailers, blockchain offers many benefits:

- Lower transaction fees:

By eliminating intermediaries in payment processing, retailers can lower transaction fees, smooth settlements, improve profit margins, and pass cost savings directly to customers, creating a competitive advantage.

- Faster cross-border payments:

Faster cross-border payments remove banking delays, allowing international customers to shop smoothly, improving global reach, which improves customer satisfaction, and helping retailers to expand into new markets easily.

- Secure records:

Some businesses now accept cryptocurrency payments, while governments verify Central Bank Digital Currencies like China’s Digital Yuan and India’s Digital Rupee to make digital payments more common.

As more people adopt them, blockchain and digital currencies will reshape retail payments, and offer secure, efficient, and inclusive solutions which drive innovation across global commerce.

Challenges like volatility, limited adoption, and unclear regulations remain, but stablecoins like USDC and Tether provide stability by linking digital value to fiat currencies.

Central Bank Digital Currencies could soon transform retail payments, as trials in China and India highlight opportunities for retailers to connect directly with secure, government backed digital platforms.

7. Real-Time Payments:

Today’s consumers expect payments to happen instantly. Real-time payment systems allow funds to move instantly between bank accounts throughout the year.

Real-time payments(RTP) are becoming one of the most transformative innovations in retail business. Real-time payments enable instant fund transfers between banks, merchants and customers throughout the day including weekends and holidays unlike traditional payment systems.

This speed not just improves convenience but also improves cash flow management for retailers who can access funds immediately after a purchase.

For consumers, RTP removes delays because of which payments reflect instantly whether you are shopping online or in-store. It is really important in today’s fast operating environment where customers expect quick, smooth, and secure checkout experiences.

Faster payments help retailers to avoid dependence on credit, reduce failed transactions, and prevent settlement delays.

All over the world, many regions are adopting real-time payment networks like India’s UPI and the U.S. RTP network.

Such systems are improving efficiency, inclusivity, and competition in retail. Instant payments give small businesses quick cash, helping them manage stock better and stay flexible in operations.

Looking ahead, as retailers integrate RTP into their payment platforms which offers speed, transparency, and reliability will reshape customer expectations. Businesses that adopt real-time payments early will gain a competitive advantage developing loyalty while ensuring smoother, future ready payment processes.

Examples:

- UPI in India, processing more than 12 billion transactions monthly.

- In the U.S., real-time payments are powered by The Clearing House, offering instant, secure fund transfers for retailers and consumers nationwide.

- PIX in Brazil is adopted by 140 million users.

For retailers, this means:

- Faster refunds.

- Instant payouts to sellers or gig workers.

- It helps for better cash flow management.

Real-time payments help for faster subscriptions, small purchases, and e-commerce refunds and gaining customer trust in online shopping.

Also Read: How to Choose the Right POS System for Your Business

8. Regulation and Compliance:

With the evolving retail payment industry, it is important for retailers to implement regulation and compliance effectively which directly impact how businesses operate and innovate. So all over the world, governments and regulators are making strict rules to protect their customers, maintain financial stability, and fair competition in retail payments.

So it is essential for retailers to stay compliant with changing payment regulations which is not just a legal responsibility but also important to build trust among your customers.

Protecting data security and privacy is an important part of compliance. Because of regulations like the PCI DSS and the GDPR require retailers to protect payment information, prevent data breaches and maintain transparency while handling data.

So if any form of non-compliance is found then retailers may have to pay heavy fines, and also reputational damage. Hence, it is important for retailers to implement strong security protocols. Because of which regulators are paying close attention to new payment models like Buy Now, Pay Later(BNPL) and cryptocurrencies.

Authorities are implementing stricter rules to stop excessive debt, support fair lending, and prevent fraud. So while the use of blockchain and digital currencies is on rise, regulators main aim is to offer both innovation and safety making it reliable for daily retail payments.

Additionally, anti-money laundering(AML) and Know Your Customer(KYC) requirements have become an important feature in digital payment systems. So retailers are partnering with payment providers to ensure transactions are tracked for any suspicious activity, eventually reducing financial crime risks.

Moving ahead, regulatory frameworks will continue to evolve along with technology. Retailers that adapt to new compliance standards by investing in secure infrastructure, transparent practices and strong partnerships which will not just avoid penalties but also gain a competitive edge. Compliance is more than a rule to follow, it helps to gain customer trust and gives a competitive edge to business.

Key areas include:

- PSD2 and Strong Customer Authentication(EU): Such authentication requires two-factor verification for electronic payments which improves security in transactions, reduces fraud, which protects consumers and gains overall trust in digital commerce.

- PCI DSS standards: It set strict requirements for handling and storing cardholder data which help businesses to protect sensitive information, prevent data breaches, reduce frauds, and maintain customer trust.

- BNPL regulations: BNPL regulations focus on strict transparency rules, requiring providers to disclose fees, repayment terms, and risks, ensuring consumers make informed decisions and protecting them from hidden debt.

- Crypto regulations: Global authorities are tightening crypto rules by enforcing anti-money laundering compliance to prevent illegal activities which helps to improve transparency, and protect investors, and build trust in digital currency markets throughout the world.

Retailers must consider compliance as a competitive advantage. Transparent, secure practices improve consumer trust and reduce fraud risks.

9. Customer Experience and Invisible Payments:

Customer experience has become the center of modern retail, and payments play an important role than ever in shaping it. A major change is the increase in the use of invisible payments.

Unlike traditional methods which require customers to swipe their cards, enter a PIN, scan a QR code, invisible payments are designed to happen smoothly in the background.

It allows customers to simply select what they need, walk out of the store, or use a service without stopping at a checkout counter. Because of the smooth process, customers don’t have to wait in queues.

It not just saves time but also creates a smooth and enjoyable payment process. Retailers will benefit due to quick transactions, more customer satisfaction, and stronger loyalty.

Examples of invisible payments are ride-hailing apps, auto-renew subscriptions, and cashier-less stores like Amazon Go. Invisible payments remove the payment step, allowing customers to enjoy their experience while improving convenience, personalization, and trust for lasting brand success.

What’s Next? Future Retail Payment Trends:

The future of retail payments is set to be faster, smarter, and more smooth.

Due to advancements in biometric authentication like facial recognition and fingerprint scans which will provide stronger security along with quick checkout.

While digital wallets and contactless options will keep growing with real-time payments that send money instantly. Buy Now, Pay Later will further grow under stricter rules, giving customers flexible but clear payment options.

Blockchain and central bank digital currencies are being studied for their ability to lower costs and build trust. Overall, the next way of payment innovation will focus on security, speed, and deliver a smooth customer experience.

Technology and finance will keep coming together, creating payment systems which are smarter, more customized and smoothly integrated into daily life.

Conclusion:

The retail payment is changing frequently because of new technology and changing customer expectations. Shoppers today require speed, security, and convenience due to which retailers have to adopt modern solutions above traditional cash and card methods.

Most contactless payments and mobile wallets such as Apple Pay and Google pay are the main payment systems which help customers to complete transactions quickly with just a tap.

Another important trend is the growth of Buy Now, Pay Later services which give consumers greater flexibility while purchasing. However stricter regulations are emerging in order to ensure transparency and responsible lending.

At the same time, real-time payments are gaining popularity, enabling instant transfers that benefit both businesses and customers by improving cash flow and reducing settlement delays.

Invisible payments where the payment process disappears into the background like ride-hailing apps or cashier-less stores which are reshaping customer experiences.

And blockchain and central bank digital currencies are being explored for their potential to reduce costs and increase trust.

While moving ahead, effective payment solutions like Ace Merchant Processing, will become more predictive, personalized, and deeply embedded into everyday retail experiences, offering retailers