Introduction

Payment processing software is the tool which enables safe and smooth digital transactions between businesses and their customers. This software makes sure that the money moves safely from a buyer’s account to a seller’s account whether the purchase is done online, in-store, or through a mobile app.

While acting as the backbone of modern commerce, payment processing software integrates with a payment gateway, card networks, and banks in order to authorize and settle transactions within seconds. So it is important for businesses to adopt strong payment processing software.

This software lets merchants allow different payment methods like credit cards, debit cards, e-wallets, and even Buy Now, Pay Later options. It provides different features like fraud detection, tokenization, recurring billing, multi-currency support, and PCI DSS compliance which keeps customer data secure.

Customers have benefits due to smooth checkout experience, faster payment approvals, and multiple payment method options. Due to which merchants gain improved cash flow, reduced errors, and improve trust by providing a reliable payment environment.

Most of the popular providers like PayPal, Adyen highlight how diverse and flexible modern payment processing systems have become.

In today’s fast paced and competitive retail and eCommerce landscape it is essential to choose the right payment processing software like Ace Merchant Processing which is not just about accepting payments but also delivering secure, efficient, and customer-friendly transactions which drives loyalty and growth.

Also Read: How to Choose the Right POS System for your Business

Understanding Payment Processing Software:

Payment processing software is a digital system that speeds up electronic financial transactions. It acts as the bridge between the customer, the merchant, the card network, and the banks, ensuring that the money is transferred from the buyer’s account to the seller’s account.

The Role of Payment processing software in Modern Commerce:

Businesses would have to depend only on cash transactions without this technology. While consumers today want to make payments through credit cards, debit cards, and wallets like Apple Pay, or even Buy Now, Pay Later(BNPL). This software not just supports different payment methods and also keeps transactions fast, secure, and compliant with regulations.

How Payment Processing Software Works:

Though a digital transaction may seem like happening instantly to the customer, in reality, several steps happen within seconds.

- Customer initiates payment – A digital starts with a buyer entering card details online, tapping a contactless card, or using a mobile wallet like Apple Pay or Google Pay.

- Data Encryption – The payment processing software then immediately encrypts sensitive cardholder information in order to prevent fraud or data theft during transmission.

- Payment Gateway Transfer – Encrypted details are sent to the payment gateway which acts as a secure channel between the merchant and banks.

- Acquiring Bank Request – The gateway forwards the request to the merchant’s acquiring bank that manages payments for the seller.

- Card Network Verification – The acquiring bank then directs the request through card networks such as Visa, Mastercard, or Amex which ensure authenticity and validity.

- Issuing Bank Authorization – The customer issuing bank checks account balance or credit availability and decides whether to approve or decline the payment.

- Response to Merchant – An approval or decline message travels back through the network, gateway, and software, reaching the merchant in seconds.

- Transaction Settlement – If the payment is approved then the issuing bank transfers funds to the acquiring bank for further settlement.

- Merchant Payout – Finally the fund is transmitted to the merchant’s account in 1-2 days.

Such a streamlined system ensures secure, fast, and reliable transactions for both customers and businesses.

Also Read: Top 5 Features Every Retailer Should Look for in Modern Payment Terminal

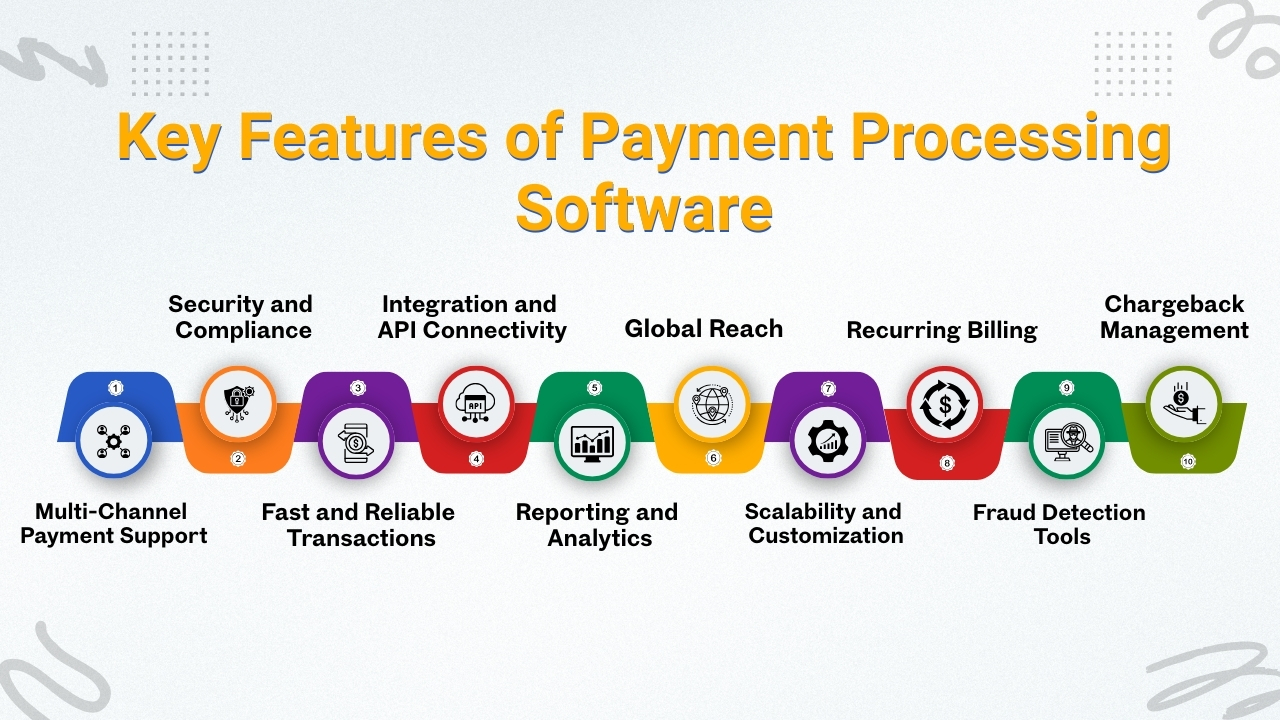

Key Features of Payment Processing Software:

Payment processing software has become an important tool for businesses whether it is mid size or large size, in order to ensure secure and efficient transactions today.

The most effective payment processing software are designed with essential features that prioritize ease of use, strong security, and the ability to grow with a business.

1. Multi-Channel Payment Support:

Modern consumers look for flexible payment options while making payments. So advanced software must support different payment methods like credit and debit cards, ACH transfers, QR codes, and cryptocurrencies.

It should also work across online, in-store, and mobile platforms, ensuring a smooth omnichannel experience.

2. Security and Compliance:

Payment processing software must provide protection to sensitive financial data. So such softwares must offer end-to-end encryption, tokenization, fraud detection tools, and compliance with global standards like PCI DSS. They must offer real-time monitoring and two-factor authentication which will protect merchants and customers.

3. Fast and Reliable Transactions:

Speed is an important feature of payment software processing software which reduces chances of cart abandoning, and improving customer satisfaction.

Some leading platforms are optimized for offering real-time approvals, reducing downtime through redundant systems, and high transaction volumes.

4. Integration and API Connectivity:

Businesses often depend on different platforms like e-commerce, CRM, and accounting tools. It is essential for payment processing software to have open APIs and plug-and-pay integrations in order to have a simple setup, less manual work, and a unified workflow.

5. Reporting and Analytics:

By having access to actionable insights allows businesses to improve operations. As such payment processing software offer dashboards which offer real-time insights on sales, refunds, chargebacks, customer behavior which let merchants to take data-driven decisions.

6. Global Reach:

Businesses who are functioning in different countries must have payment processing software that offer multi-currency support, localized payment methods, and automated tax handling.

7. Scalability and Customization:

Best payment platforms must scale with business growth and provide customized solutions which is essential for all types of businesses, let it be startups, small businesses, and large enterprises.

8. Recurring Billing:

Payment processing software offering recurring billing support allows businesses to manage subscriptions and installment payment automatically. It ensures consistent revenue, reduces manual work, and improves customer convenience.

9. Fraud Detection Tools:

Fraud detection tools in payment processing software use AI and machine learning to spot unusual patterns, flag suspicious activity instantly, prevent fraud, and improve transaction security.

10. Chargeback Management:

Chargeback management in Ace Merchant payment processing helps businesses to track claims, provide transaction data in detail, and automate responses which helps businesses to reduce disputes and financial losses by providing quick and fair resolutions which protect both merchants and customers.

In short, such software helps businesses to build trust, move money quickly, and make smarter decisions with secure tools.

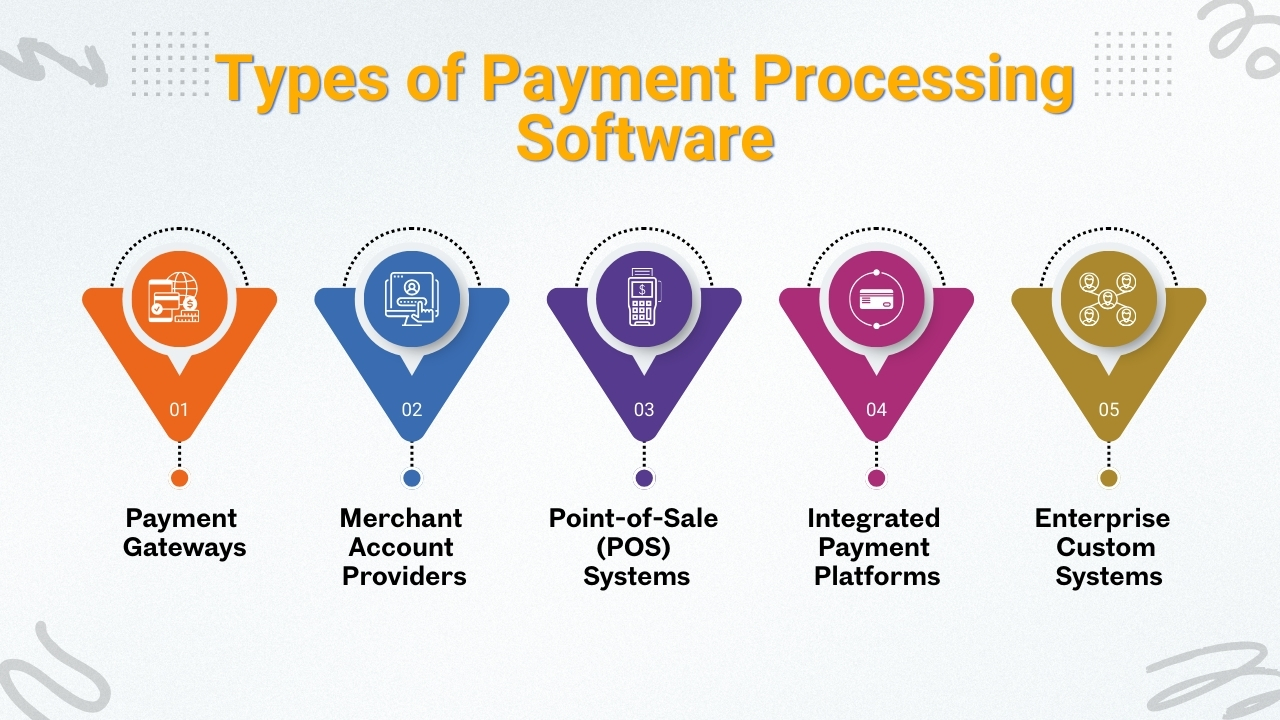

Types of Payment Processing Software:

Payment processing software comes in different forms where each software platform is designed to suit specific business models, transaction volumes, and customer needs. So it is essential to understand these software types which helps companies to select the right solution for their operations. Below are four main categories:

1. Payment Gateways:

Payment gateways is one of the most common types of payment processing software. Such software acts as a bridge between a customer, merchant, and the bank.

When a customer makes a purchase online or at checkout, the payment gateway transfers the transaction details to the acquiring bank securely. Then verifies the payment with the issuing bank. After approval the funds are transferred to the merchant account.

Payment gateways are mostly used in e-commerce, mobile apps, and subscription-based businesses. It supports credit and debit cards, digital wallets, and alternative payment methods. By offering encryption, tokenization, and PCI DSS compliance ensures data security.

Some popular examples include PayPal, Stripe. So businesses who require quick, reliable, and secure online payment collection often consider payment gateways.

Also Read: Smart POS System

2. Merchant Account Providers:

It is a specialized type of bank account which allows businesses to accept card payments. Often merchant account providers bundle their services with payment processing software in order to provide smooth fund transfers from customer’s cards to the business account.

Such providers offer fraud detection, recurring billing, and settlement reporting. Merchant account providers are mostly useful for businesses with high transaction volumes or requiring advanced payment customization. It offers stability and better rates making them suitable for enterprises, retail chains, and subscription platforms.

Though setup might take longer due to underwriting and compliance checks, and the result is greater control and reliability in managing payments.

3. Point-of-Sale(POS) Systems:

POS systems combine hardware and software to handle in-person transactions which are mostly used in retail stores, restaurants, and service businesses. These systems integrate card readers, barcode scanners, and receipt printers with software which processes payments instantly.

It also offers inventory management, customer relationship features, and sales reporting. Many now support mobile POS(mPOS) options, which allows staff to process payments anywhere within the store using tablets or smartphones.

Some examples include Toast, and Lightspeed. These systems work best for businesses that need fast in-person checkout and easy connection of payment data to other tools.

4. Integrated Payment Platforms:

Integrated payment platforms do not just do simple transaction handling by embedding payment functionality into existing business systems.

Such platforms provide APIs and SDKs which allow developers to integrate payments into e-commerce websites, booking platforms, CRMs, or SaaS applications.

By centralizing financial operations, integrated payment platforms reduce manual work, improve accuracy, and offer valuable data insights. Such systems support multiple currencies, localized payment methods, and advanced analytics which makes it ideal for businesses functioning across borders.

Companies like Ayden, Worldpay provide such comprehensive solutions. For fast growing enterprises or technology-driven businesses, integrated platforms ensure scalability and flexibility while maintaining security.

5. Enterprise Custom Systems:

Enterprise custom systems are customized payment processing solutions

Enterprise custom systems are customized payment processing solutions built to meet the unique needs of large organizations. These systems provide full customization, ensuring smooth integration with existing ERP, CRM, and accounting software.

They support high transaction volumes, multi-currency operations, and advanced security features which makes them an ideal choice for global businesses.

Enterprises can design workflows, add specific fraud detection rules, and build specialized dashboards. While development and setup require significant investment, the result will be unmatched scalability, control, and reliability. Custom systems allow enterprises to align their payment infrastructure directly with their operational and strategic goals.

Benefits of Payment Processing Software:

Payment processing software has emerged as an important providing a bridge between customers, merchants, and financial institutions. By automating and simplifying the payments, these solutions offer a wide range of benefits that go far beyond simply accepting money. Below are the key advantages.

1. Faster Transactions and Improved Efficiency:

One of the most important benefits of payment processing software is speed. Traditional manual methods like handling cash or processing checks, can be time-consuming and often cause errors.

With digital processing, payments are authorized in real time, reducing waiting times at checkout and preventing delays in online purchases.

For businesses, it means faster settlement, improved cash flow, and fewer administrative tasks. Employees spend less time on payment tasks and can focus more on running the business. For customers, quick and smooth payments translate into a better shopping experience.

2. Enhanced Security and Fraud Prevention:

Security is a top priority in financial transactions. Modern payment processing systems have features like end-to-end encryption, tokenization, and multi-layered authentication. They comply with industry standards like PCI DSS ensuring customer data is protected at every step.

Additionally, advanced solutions use artificial intelligence(AI) and machine learning(ML)algorithms to find unusual patterns, flag suspicious activities, and minimize chargebacks. By reducing fraud risks, businesses can protect revenue, maintain customer trust, and avoid any regulatory penalties.

3. Greater Convenience for Customers:

Consumers today expect flexibility while making payments. Payment processing software supports multiple payment options like credit and debit cards, digital wallets(Apple Pay, Google Pay), contactless payments, QR codes, and even cryptocurrency.

By offering customers their preferred payment method, businesses can reduce chances of cart abandonment rates and improve conversions.

For subscription-based models, recurring billing options improve convenience by automating renewals without any manual intervention. Ultimately, a smoother payment experience helps to strengthen brand loyalty.

4. Global Reach and Multi-Currency Support:

For businesses operating across borders, payment processing software eliminates the barriers of geography. Because most of the platforms offer multi-currency support, enabling customers to pay in their local currency, while merchants receive funds in their preferred currency.

Some systems also integrate with tax calculation tools, which makes it easier for companies to comply with international regulations. Such flexibility opens the door to new markets and supports global expansions without the complications of handling foreign payments manually.

5. Integration with Business Tools:

Modern payment systems can be easily integrated with e-commerce platforms, accounting software, CRM systems, and inventory management tools.

Such systems offer APIs and plug-ins through which businesses can unify financial data with existing workflows. Such integration reduces chances of any error from manual entry, improves accuracy.

Sales data can automatically sync with accounting systems due to which financial reporting and reconciliation become faster and more reliable.

6. Cost Savings and Revenue Growth:

Although payment processing involves transaction fees, the overall benefits are more than the expenses. Automated processing reduces labor expenses which are linked to manual bookkeeping and cash handling. Additionally, advanced fraud detection and chargeback management reduces financial losses.

Most importantly, offering diverse and convenient payment helps to increase sales, attract more customers, and encourage repeat purchases. Because of faster checkout experiences, there will be less chances of customers abandoning their carts due to which will lead to business growth.

7. Real-Time Reporting and Insights:

Such software offers dashboards and analytics that provide real-time insights about transactions, revenue patterns, and customer behavior which helps businesses to track sales, refunds, and chargebacks easily.

Because of insights businesses are able to make decisions by knowing customer preferences, best-selling products, and predicting demand. Due to data-driven strategies helps businesses to increase profits and stay ahead of competitors.

8. Scalability and Flexibility:

As businesses grow, their payments need to evolve. Such software is highly scalable supporting increased transaction volume, multiple currencies, and new sales channels. Whether it is a startup or enterprise, businesses can customize solutions to achieve their goals.

Also Read: The Future of Retail Payment

Challenges in Payment Processing:

Though payment processing software has changed how businesses handle transactions, still there are many challenges. Like security risks, integration challenges, companies must navigate issues to ensure smooth and reliable payment operations.

1. Security Threats and Fraud:

One of the important challenges in payment processing is security. Though there are advancements like encryption, and tokenizations, businesses still face data breaches, phishing attacks, and identity theft.

Fraudsters keep developing new methods to exploit weakness which will put customer data and revenue at risk. So, it is essential for software providers to regularly update security protocols and comply with standards like PCI DSS to maintain trust and safety.

2. High Transaction Fees:

Transaction fees for digital payments are often high mainly for small merchants with low margins. As fees differ depending on card networks, payment methods, and cross-border transactions

So over time, costs can add up but reduce profitability. So, businesses must research different processors and negotiate terms to reduce expenses without compromising service quality.

3. Integration Complexity:

Payment processing software often has to be integrated with e-commerce platforms, accounting software, CRMs, and ERP solutions. But integrating different systems can be complex and time-consuming.

If there is poor integration, then it may lead to errors, delays in financial reporting. So, it is important to select a flexible platform which has strong API support which reduces this challenge.

4. Regulatory and Compliance Issues:

As the financial industry is regulated, it is essential for payment processors to adhere to rules in different regions. So payment processors must follow PCI DSS for data security, GDPR for privacy, and local tax or anti-money laundering laws.

While businesses function in various countries, maintaining compliance becomes complicated because of changing rules in various countries. Non-compliance may cause heavy fines and reputational damage.

5. Downtime and Technical Issues:

Even a small issue in payment processing software may lead to revenue loss and customer frustration. Usually downtown happens because of server overloads, network failures, or software bugs.

While operating in industries like e-commerce or travel bookings where speedy transactions are important, these issues may harm customer trust and impact brand reputation.

So reliable processors must invest in redundancy, backups, and real-time monitoring in order to reduce downtime.

6. Customer Experience Challenges:

Customers may often get frustrated if they face payment delays, failed transactions, or lack of preferred payment methods which may often lead to card abandoning.

As customers need faster and more convenient payment experiences, so it is essential for businesses to ensure that their payment systems remain smooth, flexible, and user-friendly.

Popular Payment Processing Software Providers:

The payment processing market is highly competitive as many providers are offering secure, scalable solutions for all types of businesses.

One of the most popular payment processing software is PayPal which is well known for its reach, easy setup and wider customer adoption. It supports online, in-store, and peer-to-peer payments making it a flexible option for merchants and customers.

Another leading payment processing software is Stripe mostly used by e-commerce companies and developers. Because of popular APIs, Stripe allows smooth integration into websites, mobile apps, and Saas platforms. It supports subscription billing, fraud detection, and multi-currency payments due to which it is an ideal choice for global businesses.

Adyen is a payment processing software used by large enterprises with a unified platform which supports multiple payments all over the world. Some of its important features include scalability, advanced analytics, and cross-border transactions.

Finally, Worldpay remains a trusted provider, offering complete solutions across industries with strong compliance and fraud prevention features.

These providers are mostly used for their innovation, reliability, and ability to adapt to various business needs in the changing digital payment landscape.

Also Read: Retail Payment Trends

Choosing the Right Payment Processing Software:

It is essential to select the right payment processing software to ensure smooth business operations and gain customer satisfaction. Below are five important factors to consider:

1. Business Size and Volume:

Start by evaluating your size of company and transaction volume. For instance, small businesses often look for cost-effective providers while enterprises look for advanced and scalable platforms.

2. Supported Payment Methods:

Make sure that your payment processing software accepts different payment options like credit or debit cards, mobile wallets, ACH, and even cryptocurrency. While if you are global businesses then it is essential to offer multi-currency and local payment preferences.

3. Security and Compliance:

Payment processing software must protect sensitive customer data. So look for providers that offer encryption, tokenization, fraud detection, and compliance with PCI DSS standards which will reduce risks and build customer trust.

4. Integration Capabilities:

Select a software which will integrate smoothly with current e-commerce platforms, accounting systems, and CRMs. Often strong API support offers flexibility and efficiency.

5. Costs and Fees:

Also assess transaction fees, setup charges, and hidden costs. Then select a provider which matches your budget while maintaining service quality.

6. Scalability and Customization:

Select payment processing software that will grow with your business, offering flexibility to adapt to new markets, payment methods, and customer expectations.

Future Trends in Payment Processing:

The future of payment processing is formed by innovation, speed, and security. Contactless payments and digital wallets have become most established offering faster and convenient transactions.

AI and machine learning will better fraud detection and personalize payment experiences. While blockchain technology and cryptocurrencies are expected to offer transparent and decentralized alternatives.

Real-time payments(RTP) will prevent settlement delays, and offer immediate cash for businesses. Because of increasing adoption of Central Bank Digital Currencies(CBDCs) may transform the financial sector. Ultimately payment processors will grow into more smooth, global, and integrated digital transactions.

Conclusion:

Payment processing software such as Ace Merchant Processing is not just a tool for payments, it is the backbone of modern commerce. This software helps to connect merchants and customers by accepting payments quickly, securely and in multiple channels.

Some of the major benefits of such providers is not just transactions; rather it also improves customer convenience, operational efficiency, supports global business, while also providing insights through real-time analytics.

While your businesses grow, payment processing software grows with them, offering customizable features for startups, small retailers, and large enterprises.

By offering important features such as fraud detection, recurring billing, chargeback management, and smooth integration with other business systems, it ensures that financial operations remain reliable and future-ready.

While operating in a time where customer trust and convenience impact loyalty, it is essential to have the right payment processing system which is not just optional but it is essential.

So companies that invest in strong, secure, and flexible solutions will not just make operations smooth but also lead to long-term growth in a digital marketplace.

So, payment processing software allows businesses to build stronger customer relationships, improve operational efficiencies, and adapt to the changing financial sector.